Tax on Capital Gain on Mutual Fund / Collective Investment Scheme / REIT — 2025-2026

This is latest Capital Gain on Mutual Fund / CIS / REIT tax calculator as per 2025-2026 budget presented by Government of Pakistan.

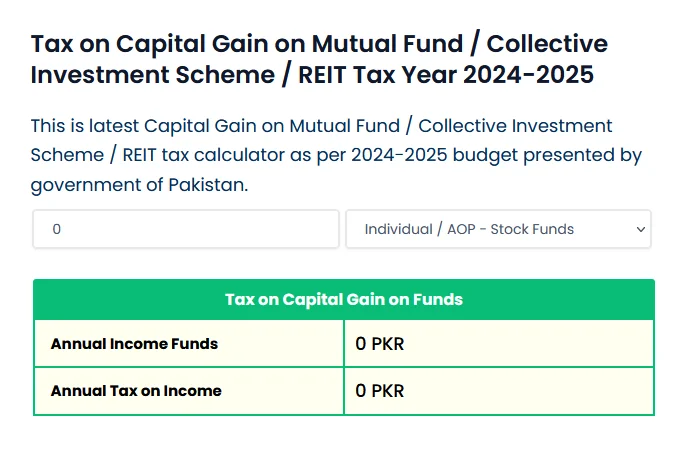

| Annual Income Funds | |

| Annual Tax on Income |

Gain Tax on Mutual Fund

Welcome to the Gain Tax on Mutual Fund Calculator

Our gain tax on mutual fund calculator is your comprehensive tool for navigating the complexities of mutual fund taxation in Pakistan. Designed to simplify the process of calculating capital gains tax on your mutual fund investments, this user-friendly calculator empowers you to make informed financial decisions. Whether you’re a seasoned investor or a novice exploring the world of mutual funds, our platform provides a convenient and efficient way to estimate your tax liabilities. Take control of your financial planning and gain valuable insights into the tax implications of your investment strategy with the Gain Tax on Mutual Fund Calculator.

What Is Capital Gains Tax on Mutual Funds?

Capital gains tax is a final wealth tax charged when you redeem units of mutual funds, Collective Investment Schemes (CIS), or Real Estate Investment Trusts (REITs). These deductions happen at the point of redemption, meaning investors don’t have to separately report them in annual tax returns, unless there’s residual income.

Why Use the Gain Tax on Mutual Fund Tax Calculator?

The Gain Tax on Mutual Fund Tax Calculator offers several compelling reasons for utilization. Here’s why you should use the Gain Tax on Mutual Fund Tax Calculator:

1. Accurate Tax Planning

Calculating capital gains tax manually can be complex, considering factors such as the holding period, type of gains, and applicable tax rates. A calculator simplifies this process, providing accurate figures for tax planning purposes.

2. Time Efficiency

The calculator can save time compared to manual calculations. By entering specific details about your mutual fund transactions, the tool can quickly generate the capital gains tax liability.

3. Compliance

Calculating capital gains tax accurately ensures compliance with tax regulations. It helps investors fulfill their tax obligations by providing a clear picture of their tax liability.

4. Projection of Future Tax Liability

Investors can use the calculator to project their future tax liabilities based on potential investment scenarios. This aids in making informed investment decisions aligned with one’s overall financial goals.

5. Portfolio Optimization

Investors may use the calculator to optimize their investment portfolio from a tax perspective. Understanding the tax consequences can influence decisions on when to buy or sell mutual fund units.

6. Risk Assessment

Investors can utilize the calculator to assess the potential tax consequences of different risk levels in their mutual fund portfolio. Understanding how gains and losses impact taxes allows for a more comprehensive risk analysis.

7. Year-End Tax Planning

Towards the end of the financial year, investors can use the calculator for year-end tax planning. By estimating the capital gains tax liability, investors can make informed decisions on whether to sell, hold, or switch mutual fund investments to optimize their tax position.

Discover the Features of the Capital Gain on Mutual Fund Tax Calculator

We offer the following prominent features in our Gain Tax on Mutual Fund Tax Calculator:

1. Accurate Calculation

The calculator provides accurate calculations for capital gains tax across various categories, including Individual/AOP – Stock Funds, Individual/AOP – Other Funds, Companies – Stock Funds, Company – Other Funds, instances where dividend receipts are less than capital gains, and situations where the holding period of the security exceeds six years. This ensures users receive dependable estimates tailored to their specific financial scenarios.

2. User-Friendly Interface

With an intuitive design, the calculator offers a user-friendly experience. Input fields are clear, and the results display is easy to interpret, ensuring accessibility for both novice and experienced users.

3. Real-Time Updates

The calculator provides dynamic, real-time updates as users input data. This feature enables instant feedback on the potential tax implications of different scenarios, facilitating quick decision-making.

4. Up-to-Date with Regulations

Aligned with the latest tax regulations for the specified tax year (2024-2025), the calculator ensures users receive calculations based on the current legal framework. Staying updated with regulatory changes is crucial for accurate tax planning.

5. Detailed Results Breakdown

The calculator provides a transparent breakdown of annual income and corresponding tax amounts. This detailed breakdown empowers users with a clear understanding of how different factors contribute to their overall tax liability.

How To Fill Out This Gain Tax on Mutual Fund Calculator?

Completing the Gain Tax on Mutual Fund Tax Calculator requires entering particular information relevant to your investment.

To use the Gain Tax on Mutual Fund Tax Calculator, follow these steps:

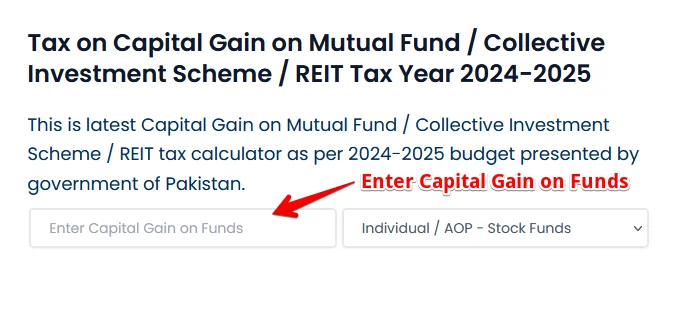

1. Enter Capital Gain on Funds – Enter the capital gain on your mutual funds in the designated field. Ensure that you provide accurate and up-to-date information reflecting your investment gains.

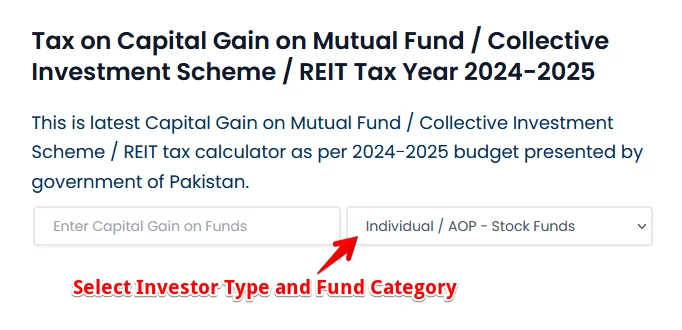

2. Select Investor Type and Fund Category – Use the dropdown menu to select your investor type and the category of the mutual fund. Choose from options such as Individual/AOP – Stock Funds, Individual/AOP – Other Funds, Companies – Stock Funds, Company – Other Funds, Dividend receipts less than capital gains, or Holding period of the security more than six years.

3. View Results – The calculator dynamically displays the calculated annual income funds tax based on the provided inputs.

Gain Tax on Mutual Fund Slabs in Pakistan 2024-2025

The Gain Tax on Mutual Fund Tax calculator is designed to simplify the intricate process of calculating tax based on the Federal Budget 2024-2025 presented by the Government of Pakistan. Our tax slabs Pakistan are structured to ensure fairness and progression in the taxation system.

-

- For individuals and associations of persons, the tax rate is 15% for both stock funds and REITs.

-

- The company applies a 15% tax rate to stock funds.

-

- The company pays a 25% tax rate to other funds like REITs.

-

- Where the dividend receipts of a stock fund are less than its capital gains, the rate of tax deduction shall be 12.5%.

-

- Where the holding period of the security exceeds six years, no capital gains tax shall be deducted.

Understanding these slabs is vital for accurate tax estimation and informed financial planning, ensuring compliance with Pakistan’s tax regulations.

How Our Capital Gain on Mutual Funds Tax Calculator Ensures Security?

Our Gain Tax on Mutual Fund Tax Calculator prioritizes your privacy and security during the estimation of gain income tax. It has been meticulously crafted to operate without the need for sensitive personal information such as your name, national identity card number, address, or bank account details. Rest assured that none of the data entered into the fields is stored or recorded.

We handle your financial information with the highest level of confidentiality, ensuring that it remains private and is not shared with any third parties.

For further assistance in protecting yourself from scams, please consult the guidelines provided in Tax Scams and Consumer Alerts. Ensuring your trust and privacy is our foremost priority as we navigate the complexities of income tax estimation in Pakistan with the Gain Tax on Mutual Fund Tax Calculator. Be assured that your confidence in our dedication to safeguarding your privacy remains our top commitment.

FAQs

Are mutual fund capital gains taxed differently for companies?

Yes. Companies investing in non-stock (debt/income) funds are taxed at 25%, while in stock funds, they are taxed at 15%—similar to individuals. This makes stock funds more tax-efficient for corporate investors.

Do you need to pay CGT if your mutual fund is in the loss?

If your mutual fund investment results in a capital loss, there is no CGT applicable. According to Pakistani tax laws, you may be eligible to carry forward your capital loss to offset future capital gains if you report the loss in your income tax return. It reduces the net tax liability in subsequent years.

Can I avoid capital gain tax on mutual funds by investing?

Currently, Pakistan doesn’t offer tax-deferred policies. However, long-term holding (over 6 years) acts as a legal tax shelter from mutual fund capital gains tax.

Are mutual fund gains taxed differently if I invest through the Roshan Digital Account?

As of now, mutual fund investments through Roshan Digital Account (RDA) follow the same gain tax rules as regular accounts. However, account holders benefit from simplified documentation and full repatriation of gains.

Support and Contact Information

For any inquiries, assistance, or personalized support, please do not hesitate to contact our dedicated support team. Our experts are ready to help you navigate through any challenges or questions you may have.

Contact Email: [help@paktaxcalculator.pk]

We value your feedback and are committed to ensuring a seamless experience with the Gain Tax on Mutual Fund Tax Calculator.