Capital Gain Properties Tax Calculator Pakistan 2024-2025

This is latest Capital Gain on Properties Tax calculator as per 2024-2025 budget presented by government of Pakistan.

| Capital Gain On Open Plots | |

| Capital Gain Annual Income Tax |

| Capital Gain On Constructed Property | |

| Capital Gain Annual Income Tax |

| Capital Gain On Flats | |

| Capital Gain Annual Income Tax |

| Capital Gain on Properties | 0 PKR |

| Legal Status | — |

| Tax Rate | — |

| Capital Gain Annual Income Tax | 0 PKR |

Gain Tax on Properties

Welcome to the Capital Gain On Properties Tax Calculator

Our Capital Gain On Properties Tax Calculator is your essential tool for accurately estimating the tax implications of property investments. Understanding the capital gains tax is crucial whether you’re a seasoned real estate investor or a first-time buyer. Our user-friendly calculator streamlines the complex process, making it accessible to everyone. Simply input the necessary details, including property purchase and sale prices, holding duration, and applicable tax rates, and let our calculator do the rest. With real-time calculations, you’ll instantly grasp the potential tax liability, empowering you to make informed financial decisions. Take the guesswork out of property investments and plan for a more secure financial future with our Capital Gain On Properties Tax Calculator.

What is the Capital Gain Tax on Properties?

Capital Gain Tax on properties is applied on the profits earned from selling immovable property—residential, commercial, or land. It is calculated as the difference between the property’s purchase price and its selling price. The Federal Board of Revenue applies CGT on real estate transactions as a part of its broader effort to regulate and document the property sector.

Why Use the Capital Gain on Properties Tax Calculator?

The Capital Gain Properties Tax Calculator serves as an essential tool for individuals and businesses engaged in Pakistan’s construction industry.

Here’s why you should use the advanced calculator:

1. Precision in Tax Strategy

Our Capital Gain On Properties tax calculator simplifies intricate capital gains tax planning by tailoring calculations to factors like holding periods, gain types, and relevant tax rates, specifically for property transactions.

2. Time-Saving Efficiency

Save time compared to manual calculations. Input income details, and our tool swiftly generates precise tax liability figures for property transactions, enhancing overall efficiency.

3. Real Estate Focus

Exclusively crafted for real estate, this calculator ensures accurate tax calculations aligned with the unique characteristics of property transactions.

4. Insights for Property Types

Distinguish between various real estate categories with insights into type-specific tax rates, helping investors comply with tax regulations and integrate precise estimates into their property financial strategies.

5. Real-Time Scenario Analysis

Input parameters in real-time, observing immediate impacts on property tax calculations. Empower dynamic decision-making based on evolving investment details in the real estate market.

6. Flexible Timeframe Options

Catering to diverse financial planning needs for real estate, the calculator supports well-informed decisions for both short-term and long-term investment goals.

7. Risk Mitigation for Compliance

By providing accurate tax calculations, the calculator helps mitigate the risk of non-compliance in real estate transactions, ensuring a smooth investment process while adhering to tax regulations.

Features of Capital Gain on Properties Tax Calculator

We offer the following prominent features in our Capital gain on properties tax calculator:

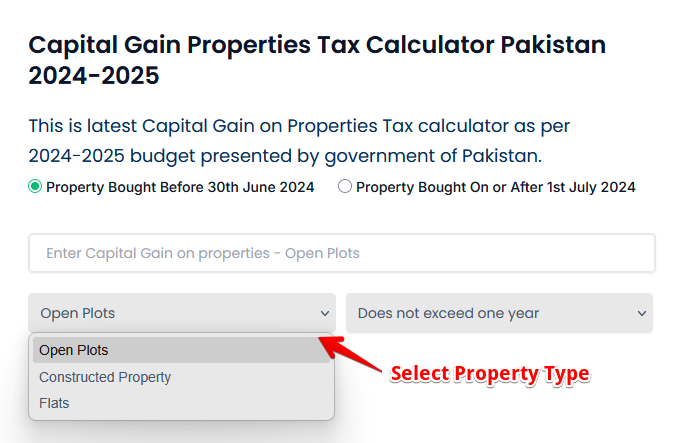

1. Classifying Types of Properties

Empowering users to classify between various types of properties, the calculator allows for separate and precise tax calculations for each category. Whether you’re dealing with open plots, constructed, or other property types, the tool ensures accuracy in tax planning.

2. Category-Specific Tax Rates

Integrating a feature to select the category of property, users can specify the real estate involved. This ensures accurate calculation of taxes, considering the specific tax rates applicable to that particular type of property.

3. Up-to-Date Tax Information

The calculator is meticulously designed to stay updated with the latest tax regulations governing properties. It incorporates information from recent real estate updates, ensuring users have access to precise and current tax details for their investments.

4. User-Friendly Interface

Boasting a user-friendly interface, the calculator simplifies the input process for property transactions. Users can effortlessly enter transaction details, make selections, and obtain instant calculations, enhancing overall usability and efficiency in tax planning.

5. Instant Real-Time Updates

Offering real-time updates and the flexibility to adjust input parameters, users witness immediate changes in calculated results for properties. This feature enables dynamic financial decision-making as investment details are modified or different options are selected in real time.

How To Fill Out This Capital Gain on Properties Tax Calculator?

Easily complete the tabs in the Capital Gain On Properties Tax Calculator following:

-

- Input your Capital Gain.

-

- Select the Financial Profile that aligns with your financial goals and circumstances.

-

- Choose the desired Year Range that corresponds to your financial considerations and objectives.

How to Use the Calculator?

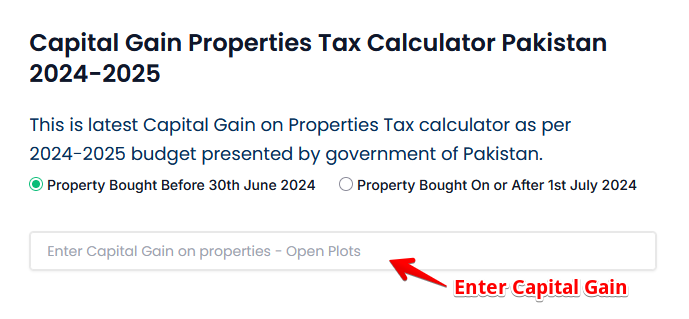

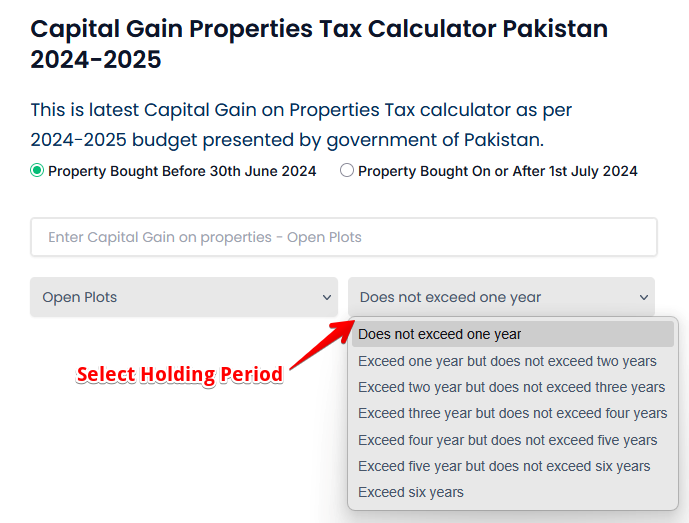

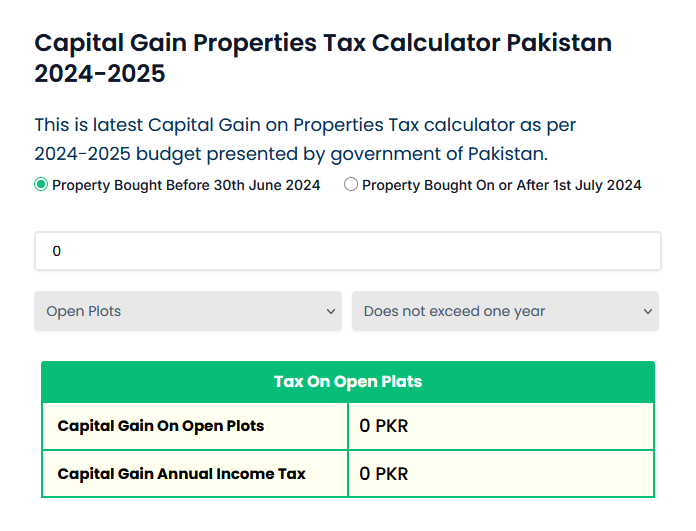

For Property Bought Before 30th June 2024:

1. Input Capital Gain – Input the amount of profit you made from selling your property.

2. Select Property Type – Choose between Open Plots, Constructed Property, or Flats.

3. Select Holding Period – Choose how long you held the property before selling (e.g., under 1 year, 2–3 years, etc.).

4. View Results – The tool will show you:

-

- Capital Gain on Property

- Capital Gain Annual Income Tax

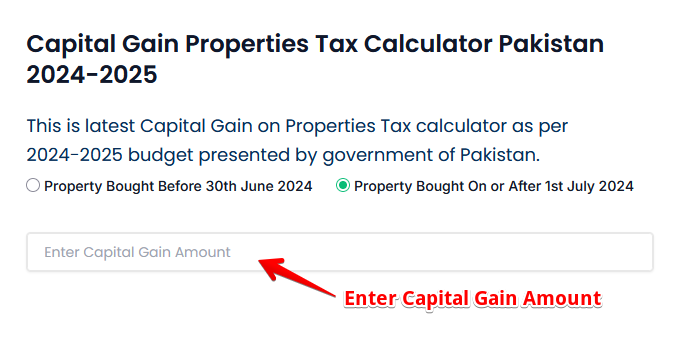

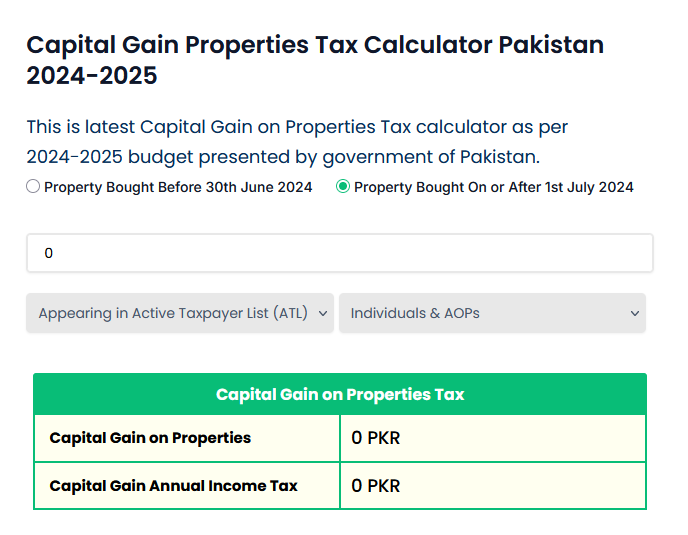

For Property Bought On or After 1st July 2024:

1. Enter Capital Gain Amount – Choose ATL Status:

-

- Appearing in Active Taxpayer List (ATL)

- Not Appearing in ATL

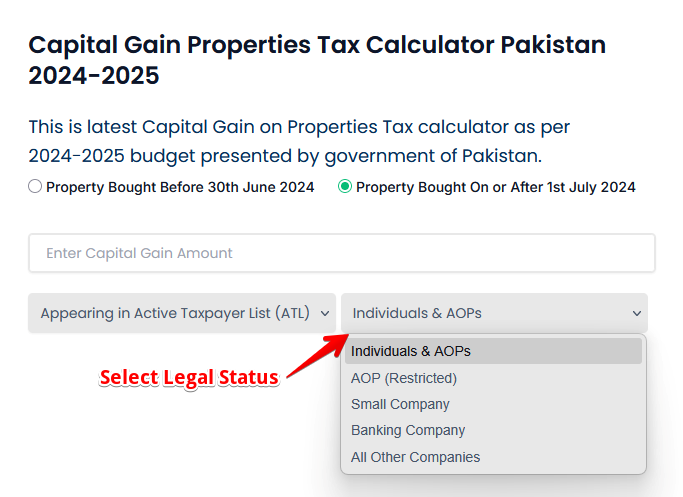

2. Select Legal Status – Options include:

-

- Individuals & AOPs

- AOP (Restricted)

- Small Company

- Banking Company

- All Other Companies

3. View Instant Results– You’ll see:

-

- Capital Gain on Properties

- Capital Gain Annual Income Tax

Capital Gain Tax on Properties Slabs in Pakistan 2024–2025

The Capital Gain on Properties Tax Calculator is built to simplify the complex process of tax calculation as per the Federal Budget 2024–2025 presented by the Government of Pakistan. Our updated tax slabs ensure fair, progressive taxation based on property type and holding period.

1. For Property Bought Before 30th June 2024:

|

Holding Period (Year) |

Open Plots |

Constructed Property |

Flats |

|

≤ 1 |

15% |

15% |

15% |

|

1 – 2 |

12.50% |

10% |

7.50% |

|

2 – 3 |

10% |

7.50% |

0 |

|

3 – 4 |

7.50% |

5% |

– |

|

4 – 5 |

5% |

0 |

– |

|

5 – 6 |

2.50% |

– |

– |

|

6+ |

0% |

– |

– |

2. For Property Bought On or After 1st July 2024:

Tax rates are based on your ATL (Active Taxpayer List) status and legal entity type:

Understanding these slabs is vital for accurate tax estimation and informed financial planning, ensuring compliance with Pakistan’s tax regulations.

- Appearing in ATL: Flat 15%tax rate for all entities.

- Not Appearing in ATL:

- Individuals & AOPs: Slab-based progressive tax rates ranging from 15% to 40%.

- AOP (Restricted): Up to 45%.

- Small Companies & Banking Companies: Up to 40%.

- All Other Companies: Flat 29%on total capital gain.

Understanding these slabs ensures you calculate tax accurately, stay compliant with national tax laws, and make better investment decisions.

How to Calculate Capital Gains Tax on Real Estate

To manually calculate your CGT, follow this formula:

Capital Gain = Sale Price – (Purchase Price + Allowable Expenses)

CGT Payable = Capital Gain × Applicable Tax Rate

Example:

Bought a plot for PKR 5,000,000

Sold it for PKR 8,000,000 after 2.5 years

Gain = PKR 3,000,000

If the plot is bought before July 1, 2024: Tax Rate = 10% (for holding period >2 years ≤3 years)

Tax Payable = 3,000,000 × 10% = PKR 300,000

If the plot is bought after July 1, 2024: Tax Rate = 15%

Tax Payable = 3,000,000 × 15% = PKR 450,000

How Our Capital Gain On Properties Tax Calculator Ensures Security?

Our Property Gain Calculator prioritizes your privacy and security when estimating taxes. It is meticulously designed to function without requiring sensitive personal information, such as your name, national identity card number, address, or bank account details. Rest assured that none of the data you enter into the fields is stored or recorded.

We treat your financial information with the utmost confidentiality, ensuring that it is not shared with any third parties.

For additional guidance on safeguarding yourself from scams, please refer to the Property Tax Scams and Consumer Alerts guidelines. Your trust and privacy are our primary concerns as we assist you in navigating the complexities of property gains tax estimation using the Property Gain Calculator. Rest assured, your confidence in our commitment to your privacy is our top priority.

FAQs

Who Is Liable to Pay Capital Gains Tax on Property Sales?

Anyone who earns a profit from selling property in Pakistan is liable to pay CGT. This includes:

- Individual residents (salaried or non-salaried)

- Companies or partnerships

- Non-resident Pakistanis and overseas investors

However, certain exemptions may apply in cases such as inherited property, gifts, or properties held beyond a specific period.

Can I offset renovation costs or transfer fees from the gain tax?

Yes, you can offset the costs of renovation. They fall in allowable expenses, which include renovation costs, commission fees, and legal transfer charges; they can be deducted from the gain.

Is capital gain tax applied to agricultural land?

Agricultural land is covered under the definition of immovable property. Therefore, any gain from the sale of the agricultural land will be taxable.

Support and Contact Information

For any inquiries, assistance, or personalized support, please do not hesitate to contact our dedicated support team. Our experts are ready to help you navigate through any challenges or questions you may have.

Contact Email: [help@paktaxcalculator.pk]

We value your feedback and are committed to ensuring a seamless experience with the capital gain on properties tax calculator