Business Tax Calculator Pakistan 2025-2026

This is the latest business tax calculator as per 2025-2026 budget presented by the Government of Pakistan.

| Accounting Profit | |

| Tax On Profit | |

| Profit After Tax |

Pakistan Business Tax Calculator

Welcome to Pakistan Business Tax Calculator

Pakistan business tax calculator is your reliable tool for effortless and accurate business tax computations. Specifically designed for Pakistani businesses, our calculator simplifies the complexity of tax calculations, ensuring compliance and efficiency.

Whether you’re a small enterprise or a large corporation, our user-friendly platform provides tailored solutions to meet your unique tax requirements. Experience hassle-free tax calculations and stay informed of the latest tax regulations. Start optimizing your business tax strategy today!

Why Choose Our Business Tax Estimation Tool?

Here’s why opting for our estimator is the smart choice when it comes to calculating business taxes:

1. User-Friendly Interface

Navigating the intricacies of business taxation can be a daunting task. Our Business Tax Calculator simplifies the process with its user-friendly interface, making it a breeze to input your business details and receive instant, hassle-free calculations.

2. Precision and Real-Time Updates

Stay ahead of the curve with our regularly updated calculator, reflecting the latest tax laws and regulations as per the governing authorities. This commitment to real-time information ensures accurate calculations, reducing the chances of errors associated with manual computations.

3. Tailored for Your Business

Whether you’re a seasoned entrepreneur or just starting, our calculator offers personalized calculations. Input specific details such as business income, deductions, and exemptions to receive a customized estimate of your tax liability.

4. Strategic Financial Planning

Anticipating your tax obligations is vital for effective financial planning. Our calculator provides a clear overview of your tax commitments, empowering you to budget effectively and make well-informed decisions about your business finances.

5. Ensures Regulatory Compliance

Compliance with tax regulations is non-negotiable. Our estimator aids in this by delivering precise tax calculations, ensuring that you pay the correct amount of tax and sidestep any legal issues associated with non-compliance.

6. Versatile for Various Business Scenarios

Adaptable to different business scenarios, our estimator is invaluable – whether you’re evaluating investments, planning for expansion, or simply assessing your tax responsibilities. Gain quick insights into the impact of various financial elements on your tax liability.

7. Free and Accessible

Accessible online at no cost, the Business Tax Calculator is a convenient tool for businesses of all sizes. No need for specialized software – simply access the calculator from any device with internet connectivity.

Discover the Features of the Business Tax Calculator

Explore the standout functionalities incorporated in our Business Tax Calculator:

1. Comprehensive Tax Slabs

Gain valuable insights into tax rates tailored to diverse business income ranges for the specified tax year. Whether your business revenue is moderate or surpasses expectations, our calculator ensures precise tax rate applications for optimal accuracy.

2. Fiscal Year Selector

Choose the pertinent fiscal year effortlessly from the dropdown menu. With a user-friendly interface, our calculator makes it convenient for you to align your tax calculations with the specific fiscal period that applies to your business.

3. Easy to Use

Navigate through our calculator with ease. Whether you’re an individual taxpayer, an employer, or a payroll manager, our tool is designed for everyone.

4. Advanced Customization

Tailor the calculator to suit the unique needs of your business. Customize income inputs based on different periods, such as monthly, weekly, or hourly, ensuring a personalized calculation experience. Consider additional factors like business size, industry specifics, and other relevant parameters to refine your tax estimates.

How to Fill in the Blanks of Business Tax Calculator?

Follow these easy steps to effortlessly fill up the Business Tax Calculator.

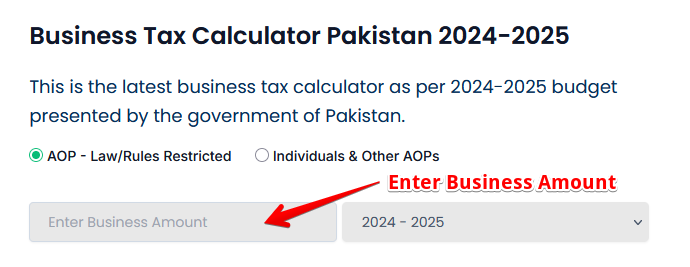

1. Business Amount Input – Enter the total business amount in the provided field.

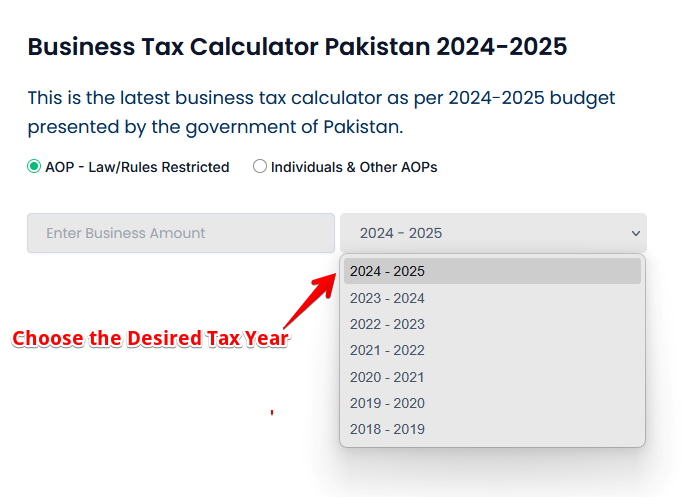

2. Fiscal Year Selector – Choose the relevant fiscal year from the dropdown menu.

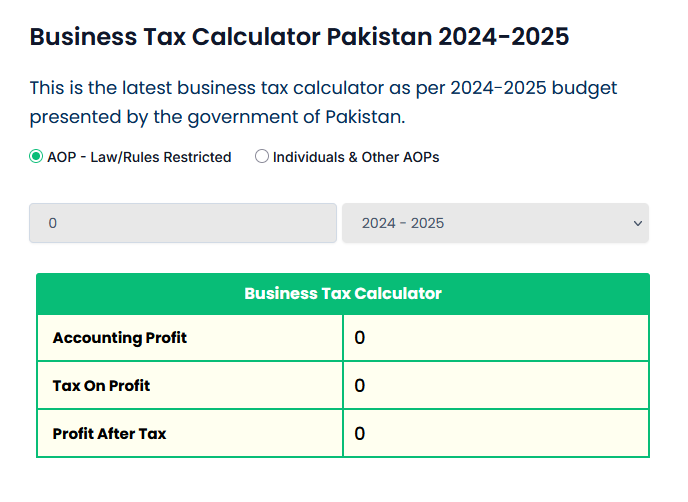

3. View Results – The calculator uses the entered data to perform real-time tax calculations based on the selected fiscal year. The results include Accounting Profit, Tax on Profit, and Profit After Tax.

Whether you’re a pro or a first-time user, our user-friendly interface ensures a smooth experience, empowering you to make informed financial decisions.

Tax Slabs for Business Tax Calculation in Pakistan 2025-2026

The Business Tax calculator is designed to simplify the intricate process of calculating income tax based on the Federal Budget 2025-2026 presented by the Government of Pakistan. The tax slab for business is structured to ensure fairness and progression in the taxation system.

|

Taxable Business Amount (PKR) |

Tax Rate |

Tax Calculation |

|

Up to Rs. 600,000 |

0% |

No tax |

|

Rs. 600,001 – Rs. 800,000 |

7.5% |

7.5% of amount exceeding Rs. 600,000 |

|

Rs. 800,001 – Rs. 1,200,000 |

15% |

15% of amount exceeding Rs. 800,000 |

|

Rs. 1,200,001 – Rs. 2,400,000 |

20% |

20% of amount exceeding Rs. 1,200,000 |

|

Rs. 2,400,001 – Rs. 3,000,000 |

25% |

25% of amount exceeding Rs. 2,400,000 |

|

Rs. 3,000,001 – Rs. 4,000,000 |

30% |

30% of amount exceeding Rs. 3,000,000 |

|

Above Rs. 4,000,000 |

35% |

35% of amount exceeding Rs. 4,000,000 |

Understanding these slabs is vital for accurate tax estimation and informed financial planning, ensuring compliance with Pakistan’s tax regulations.

Ensure Security with Our Business Tax Calculator

Our Business Tax estimator prioritizes your data privacy and security. Harnessing advanced encryption and data protection measures, we ensure that your sensitive financial information is protected. Pak Tax Calculator does not ask for your national identity card number, NTN, or bank details; it does not even ask for your name. The only thing you need to provide is the income figure, and our calculator will provide the tax liability amount.

Trust in a platform that’s dedicated to safeguarding your data while providing accurate and reliable tax calculations.

Please refer to Tax Scams and Consumer Alerts guidelines for additional guidance on safeguarding yourself from scams. Your trust and privacy are our top priorities as we help you navigate the complexities of business tax estimation in Pakistan.

FAQs

Can I deduct business losses from previous years in my current tax calculations?

Yes, under Section 57 of the Income Tax Ordinance, unadjusted business losses can be carried forward up to 6 years. This impacts net taxable income but isn’t handled in basic calculators unless manually inputted. Consult our Income Tax Filing services for better interpretation of tax liability when you have incurred a business loss in previous years.

Which tax year is supported?

Pak Tax Calculator is a comprehensive tool designed to calculate taxes of up to 7 previous fiscal years, i.e, 2018-19 to 2025-26. We have made this tax calculator for business income with innovative features to help you understand the incremental tax rates and amounts.

Who should use this calculator?

We have designed this business income tax calculator for every person and business. Whether you are a sole proprietor, AOP (Association of Persons), entrepreneur, or large-scale corporation, the business tax calculator provides precise calculations to make informed decisions.

Support and Contact Information

For any inquiries, assistance, or personalized support, please do not hesitate to contact our dedicated support team. Our experts are ready to help you navigate through any challenges or questions you may have.

Contact Email: [ help@paktaxcalculator.pk ]

We value your feedback and are committed to ensuring a seamless experience with the Business Tax Calculator.