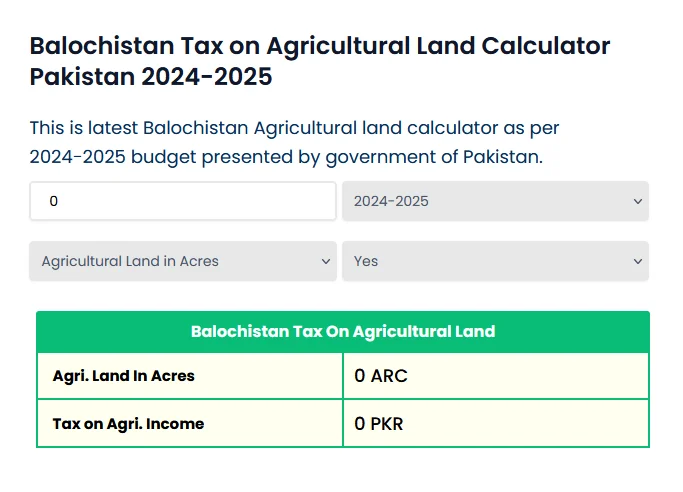

Balochistan Tax on Agricultural Land Calculator Pakistan 2024-2025

This is latest Balochistan Agricultural land calculator as per 2024-2025 budget presented by government of Pakistan.

| Agri. Land In Acres | |

| Tax on Agri. Income |

| Matured. Land In Acres | |

| Tax on Matured. Income |

Tax On Agricultural Land – Balochistan

Welcome to the Balochistan Agricultural Land Tax Calculator

Our Balochistan Agricultural Land Tax Calculator is an innovative tool designed to simplify the complex process of determining taxes on agricultural land in the province of Balochistan. This user-friendly calculator has been developed to assist farmers, landowners, and stakeholders in the agricultural sector by providing a streamlined and accurate means of calculating tax obligations. Balochistan’s rich agricultural landscape plays a pivotal role in the region’s economy, and this calculator aims to enhance transparency and efficiency in the taxation process. Whether you are a seasoned landowner or a newcomer to the agricultural sector, our calculator is here to empower you with the information you need to navigate the taxation landscape effectively. Discover a convenient and reliable way to estimate your tax liabilities and make informed decisions for a sustainable and prosperous agricultural future in Balochistan.

Why Use the Balochistan Agricultural Land Tax Estimator?

The Agricultural Land Tax Calculator for Balochistan stands as an invaluable resource for individuals and entities with agricultural land holdings in the Balochistan region. Embracing this calculator offers numerous advantages:

1. Precision in Tax Calculation

This tool aids in the accurate calculation of tax obligations for agricultural land, taking into account current tax rates and relevant parameters. Ensuring compliance with applicable rules and regulations, it guarantees that landowners fulfill their tax responsibilities by paying the correct amount.

2. Time-Efficient Solution

Manual tax calculations are often laborious and prone to errors. The Balochistan Tax on Agricultural Land Calculator simplifies this process, providing swift and accurate results. This proves particularly beneficial for individuals and businesses seeking to expedite tax calculations without sacrificing accuracy.

3. Regulatory Compliance

Ensuring compliance with tax laws is paramount to avoid penalties and legal issues. The Balochistan Tax on Agricultural Land Calculator empowers taxpayers to quickly and effortlessly evaluate their obligations, fostering adherence to tax regulations in the Balochistan region.

4. Financial Management Benefit

A crucial aspect of effective financial planning is understanding anticipated tax liabilities. This understanding aids individuals and businesses in budgeting for tax payments, promoting seamless financial operations without unexpected tax burdens.

5.Adaptability to Legislative Changes

Given the periodic changes in tax laws and rates, it’s essential to stay informed. The official Balochistan Tax Calculator is regularly updated to incorporate any modifications in tax laws, providing users with access to the latest information.

6. Improved Clarity in Assessment

This calculator enhances the transparency of the tax calculation process. By allowing users to input specific details, it delivers a comprehensive breakdown of the tax computation, facilitating a clear understanding of the factors contributing to the overall tax amount.

7. Ease of Access and User-Friendly Interface

Freely available online, the Balochistan Tax on Agricultural Land Calculator serves as a convenient resource for users. With no need for specialized software or tools, individuals can access this calculator from any internet-connected device, ensuring ease of use and accessibility.

Features of Our Balochistan Agricultural Land Tax Calculator

We offer the following prominent features in our KPK tax on agricultural land tax calculator:

1. Real-Time Tax Updates

This calculator is consistently kept up-to-date to reflect the most recent tax rates and regulations governing agricultural land in Balochistan, ensuring that users have immediate access to the latest and most accurate information.

2. Versatile Tax Year Selection

Users can effortlessly choose the specific tax year for their agricultural land tax calculations through the tool’s dropdown menu, which offers multiple years. This feature enables users to conduct both current and historical tax assessments with ease.

3. Diverse Land Classifications

The calculator provides users with the flexibility to select from various land types for tax calculations, including agricultural land and mature orchard land. This capability allows for precise tax computations tailored to specific land categories, enhancing accuracy in assessments.

4. Intuitive User Interface

Designed for user-friendliness, the calculator’s interface incorporates straightforward input fields for land dimensions, uncomplicated dropdown menus for options, and clearly presented results for easy comprehension. This design ensures an intuitive and user-friendly experience.

5. Cross-Device Compatibility

The calculator’s responsive design guarantees seamless functionality across a range of devices, from desktop computers and laptops to tablets and smartphones. This ensures a consistent and user-friendly experience regardless of the chosen platform, promoting accessibility and convenience for all users.

How To Fill Out Balochistan Agricultural Land Tax Calculator?

To make effective use of the Balochistan Agricultural Land Tax Calculator, it is crucial to provide precise details pertaining to your agricultural land and indicate your preferences regarding taxation.

Follow these steps to use this Balochistan Agricultural Land Tax Calculator:

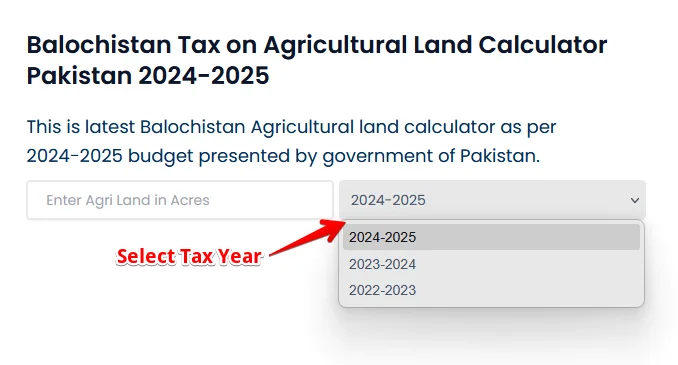

1. Select the Tax Year – Specify the specific tax year for which you require the calculation of agricultural land tax. Choose from options such as the current year, the preceding year, or other pertinent years.

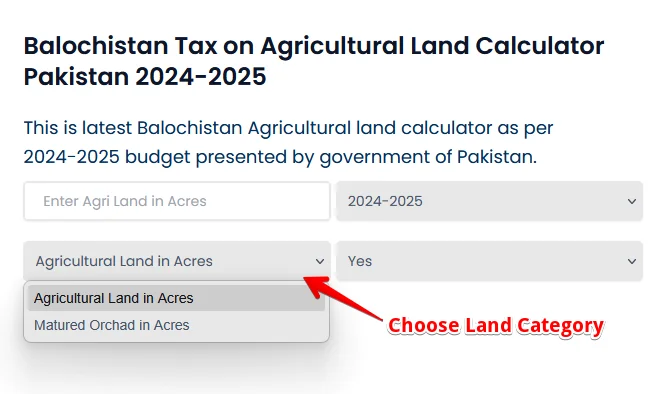

2. Choose Land Category – Pick the type of land for your tax calculation. The available options may consist of “Agricultural Land” or “Matured Orchard.”

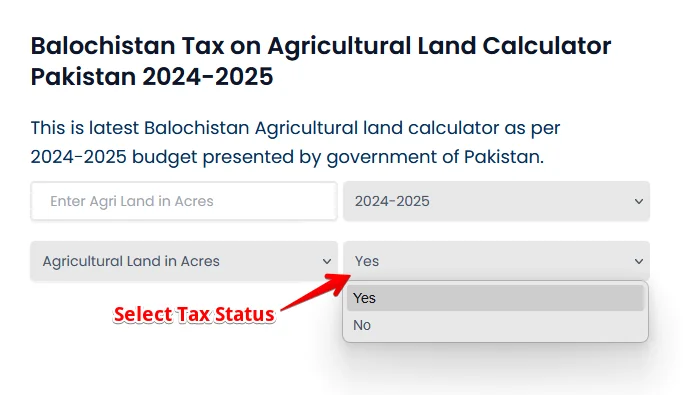

3. Determine Tax Obligation Status – Select “Yes” if you are liable for taxes, or choose “No” if you are exempt from tax obligations.

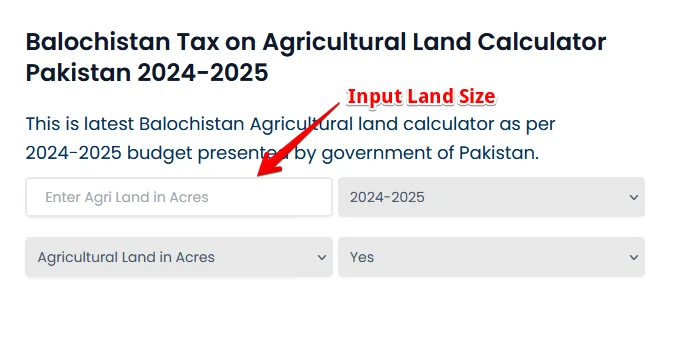

4. Input Land Size – When addressing agricultural land, locate the designated input field titled “Enter Agri Land in Acres.” Enter the acreage of your agricultural land into this specified field.

5. Review Results – After inputting the information, the calculator will promptly showcase the results, presenting details such as “Balochistan Tax On Agricultural Land,” land size, and the corresponding tax amount.

Balochistan Agricultural Land Tax Slabs (2024-2025)

The Balochistan Agricultural Land Tax calculator is designed to simplify the intricate process of calculating income tax based on the Federal Budget 2024-2025 presented by the Government of Pakistan. Our income tax slabs Pakistan are structured to ensure fairness and progression in the taxation system.

- For Agricultural Land in Acres

- Where the taxable area exceeds 0 acres, the tax rate is Rs. 50 Per Acre for Irrigated and Rs. 0 Per Acre for Unirrigated.

- For Matured Orchad in Acres

- Where the taxable area exceeds 0 acres, the tax rate is Rs. 200 Per Acre for Irrigated and Rs. 0 Per Acre for Unirrigated.

Understanding these slabs is vital for accurate tax estimation and informed financial planning, ensuring compliance with Pakistan’s tax regulations.

How Our Tax Calculator for Balochistan Agricultural Land Ensures Security?

Our Balochistan Agricultural Land Tax Estimator prioritizes the protection of your privacy and security. It operates without requiring the inclusion of sensitive personal details, such as your name, national identity card number, address, or bank account information. Be assured that we neither retain nor record any data entered into the designated fields.

We handle financial information with the highest level of confidentiality, ensuring that it remains secure and undisclosed to third parties.

For additional guidance on safeguarding yourself from scams, please consult the guidelines on Tax Scams and Consumer Alerts. Your trust and privacy are our primary concerns as we assist you in navigating the complexities of income tax estimation in Pakistan.

Support and Contact Information

For any inquiries, assistance, or personalized support, please do not hesitate to contact our dedicated support team. Our experts are ready to help you navigate through any challenges or questions you may have.

Contact Email: [help@paktaxcalculator.pk]

We value your feedback and are committed to ensuring a seamless experience with the Balochistan Agricultura