Tax on Annual Income of Companies for Tax Year 2024-2025

This is latest Tax on Annual Income of Companies tax calculator as per 2024-2025 budget presented by government of Pakistan.

| Annual Income | |

| Tax on All Other Companies |

| Annual Income | |

| Tax on Banking Company |

| Annual Income | |

| Tax on Small Company |

Tax on Annual Income of Companies

Welcome to the Pakistan Annual Income of Companies Tax Calculator

Our Pakistan Annual Income of Companies Tax Calculator is your reliable tool for assessing the tax liabilities of businesses operating in Pakistan. This user-friendly calculator is designed to streamline the complex process of determining annual income tax for companies, ensuring accuracy and compliance with the country’s tax regulations. Whether you are a small enterprise or a large corporation, this calculator provides a comprehensive and efficient solution to help you navigate the intricate landscape of corporate taxation. With up-to-date information and a user-friendly interface, this tool aims to empower businesses by simplifying the tax calculation process, allowing them to make informed financial decisions and contribute to the economic growth of Pakistan.

Why Use the Annual Income of Companies Tax Calculator?

The Annual Income of Companies Tax Calculator serves several important purposes for both businesses and government authorities. Here are some key reasons why it is commonly used:

1. Tax Compliance

The calculator helps businesses ensure they are compliant with tax regulations by accurately determining their annual income tax liability. This is crucial for avoiding legal issues and penalties associated with incorrect tax reporting.

2. Investor Confidence

Investors often assess a company’s financial health before making investment decisions. The annual income tax calculation provides insights into a company’s profitability and financial stability, influencing investor confidence.

3. Budgeting

Knowing the amount of income tax that a company owes allows for more accurate budgeting. It helps businesses set aside the necessary funds to cover their tax obligations and prevents unexpected financial strain.

4. Helpful for Financial Planning

Companies use the calculator as a tool for financial planning. By estimating their annual income tax, businesses can better allocate resources, plan for tax payments, and make informed financial decisions.

5. Government Revenue Planning

Government authorities use data from corporate income taxes to plan and allocate public resources. Understanding the overall tax revenue generated by businesses is essential for formulating budgets and implementing public policies.

6. Legal Compliance

The tax calculator assists companies in adhering to tax laws and regulations specific to their jurisdiction. This ensures that businesses operate within the legal framework and fulfill their fiscal responsibilities.

7. Tax Credits and Deductions

Businesses can use the calculator to identify potential tax credits and deductions. This helps in optimizing tax efficiency by taking advantage of available incentives, ultimately reducing the overall tax liability.

Features of Pakistan Annual Income of Companies Tax Calculator

Our Annual Income of Companies Tax Calculator includes the following notable features:

1. User-Friendly Interface

The calculator boasts a user-friendly interface designed for easy navigation and interaction, ensuring a seamless experience for users.

2. Real-Time Updates

Incorporates real-time updates, allowing users to stay informed about the latest tax regulations and adjustments presented by the government of Pakistan.

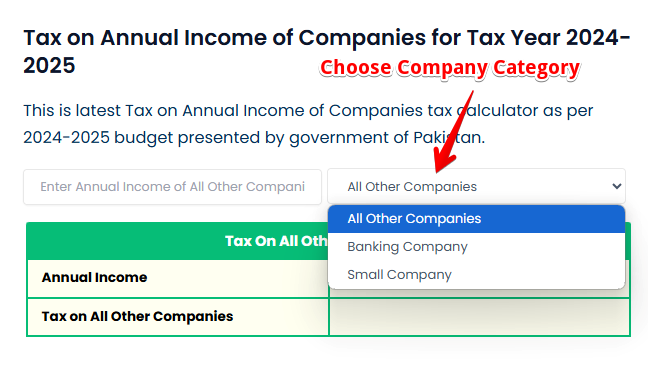

3. Multi-Category Support

Supports multiple categories, including All Other Companies, Banking Company, and Small Company, providing flexibility for diverse businesses.

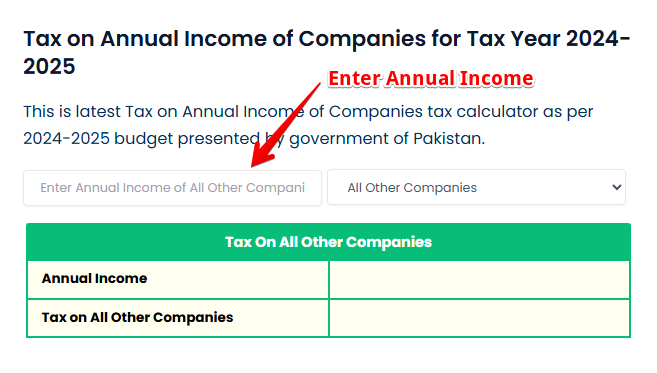

4. Dynamic Input Fields

Utilizes dynamic input fields that adjust based on the selected category, enhancing the calculator’s adaptability to different types of businesses.

5. Comprehensive Tax Calculation

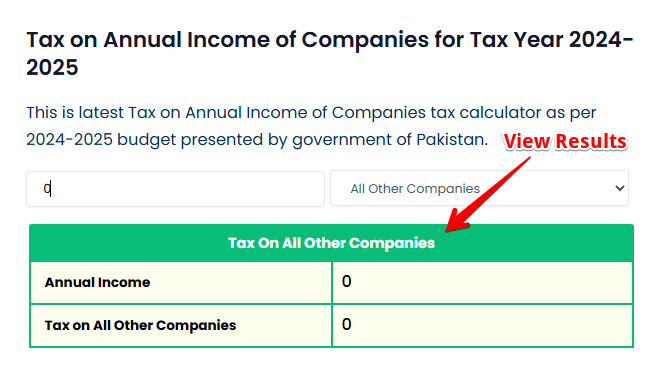

Performs comprehensive tax computations based on the annual income of companies, ensuring accurate results and compliance with the 2024-2025 budget.

How To Fill Out This Annual Income of Companies Tax Calculator?

Filling out the Annual Income of Companies Tax Calculator is a straightforward process. Follow these steps to input the necessary information and obtain accurate tax calculations:

To use the Annual Income of Companies Tax Calculator, follow these steps:

1. Choose Company Category – The calculator supports different categories such as “All Other Companies“, “Banking Company” and “Small Company.” Select the appropriate category that aligns with your business type.

2. Enter Annual Income – Depending on the chosen category, enter the annual income of your company in the designated input field.

3. View Results – As you input the annual income, the calculator dynamically displays the corresponding tax calculations.

Annual Income of Companies Tax Slabs in Pakistan 2024-2025

The annual income of companies tax calculator is crafted to streamline the complex task of computing income tax according to the Federal Budget 2024-2025 unveiled by the Pakistani Government. Our Pakistan annual income of companies tax slabs are organized to promote fairness and progression within the tax system.

-

- Tax on All Other Companies – Calculates the tax amount based on the entered annual income using a tax rate of 29%.

-

- Tax on Banking Company – Calculates the tax amount based on the entered annual income using a tax rate of 39%.

-

- Tax on Small Company – Calculates the tax amount based on the entered annual income using a tax rate of 20%.

It’s crucial to grasp these slabs for precise tax estimates and well-informed financial planning, ensuring adherence to Pakistan’s tax regulations.

Secure and Updated Annual Income of Companies Tax Estimator

Ensuring your privacy and security is our top priority with the Annual Income of Companies Tax Calculator. It functions without requiring sensitive personal details such as your name, national identity card number, address, or bank account information. Be confident that none of the data you input into the fields is stored or recorded.

We handle financial information with the highest level of confidentiality and do not disclose it to third parties.

For additional guidance on protecting yourself from tax scams, please consult the guidelines on Tax Scams and Consumer Alerts. As we assist you in navigating the intricacies of estimating Annual Income of Companies Tax in Pakistan, rest assured that your trust and privacy remain our utmost priorities.

Support and Contact Information

Feel free to reach out to our dedicated support team for any inquiries, assistance, or personalized support. Our experts are readily available to assist you in navigating through any challenges or addressing any questions you may have.

Contact Email: [tech-review@email.com]

We value your feedback and are committed to ensuring a seamless experience with the Annual Income of Companies Tax Calculator .