Capital Value Tax (CVT) is basically a tax that governments use to collect money based on the value of certain assets—not the income they make, but their actual worth. The idea behind CVT is to generate revenue and make the tax system fairer. In Pakistan, CVT applies to things like property, expensive vehicles, and even foreign assets owned by residents.

Over the years, how this tax works has changed quite a bit. The government has tried to strike a balance—on one hand, bringing in much-needed revenue, and on the other, encouraging economic growth.

For both taxpayers and policymakers, understanding how CVT works is important as this affects how assets are valued, what taxes need to be paid, and how future policies are shaped.

In this guide, we’ll discuss what CVT means for you and how it fits into Pakistan’s developing tax system.

The History of Capital Value Tax in Pakistan

Capital Value Tax has been introduced in Pakistan again through Section 8 of the Finance Act 2022. It was first implemented in 1989 and was abolished by the government in 2020. The tax is reintroduced to streamline tax collection.

In 2020, the Sindh government scrapped CVT on property deals. The goal was to boost the real estate and construction sectors, even though it meant giving up around Rs. 5 billion in yearly taxes. They expected this move would create more jobs and spark economic activity.

At the same time, the federal government took a different route. Through the Finance Bill 2022, they introduced a 1% CVT on foreign assets worth over Rs. 100 million, owned by resident Pakistanis to increase transparency and pull in more revenue. But not everyone was on board, and also there were legal challenges that eventually, the Supreme Court cut the rate down from 100% to 50% for some cases.

According to the latest regulations, the rate on the purchase of immovable, movable, and other assets of Pakistani residents is 1%. Amount, rates, and structure can differ depending on the type of assets. Every investor or property buyer in Pakistan must understand CVT because it directly impacts the overall cost of the transactions.

Why has the Pakistani Government Reintroduced the Capital Value Tax?

The Pakistani government has reintroduced the Capital Value Tax (CVT) as part of its efforts to increase revenue and bring more transparency to high-value asset transactions.

1. Revenue Generation

Taxing the rich through CVT is an effective source of revenue generation for the Pakistani government. It essentially impacts the sectors that hold significant untaxed value, like real estate. By taxing high-value assets, the government can boost its revenue without heavily burdening the lower-income segments of society.

2. Encouraging Transparency

With mandatory electronic declaration and regular assessments, Capital Value Tax plays a role in enhancing transparency in asset ownership. It enables FBR to capture wealth hidden in offshore accounts or unreported asset values.

Assets Subject to CVT in Pakistan

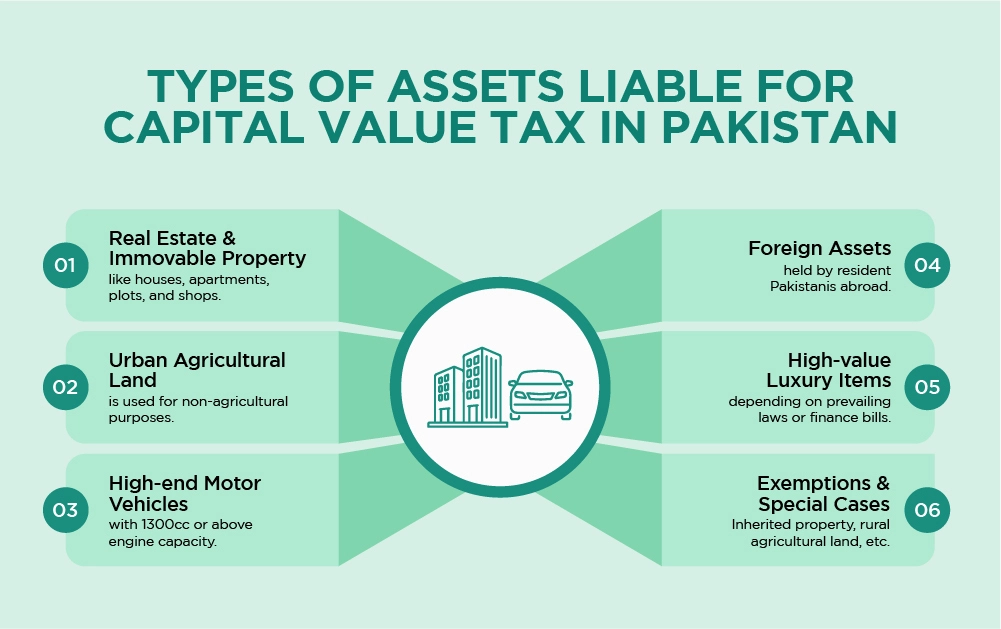

In Pakistan, Capital Value Tax (CVT) is mainly applied to certain high-value assets.

Real Estate and Immovable Property

The most common asset subject to CVT is real estate, including residential and commercial properties such as:

- Houses

- Apartments

- Shops

- Plots of land

CVT is typically calculated based on the assessed value or declared value of the property at the time of transfer or purchase. The application of Capital Value Tax on the immovable property is 2% of the assessed property value in Pakistan. The federal government introduced specific measures targeting certain categories of real estate.

In urban areas, this is often based on the property’s market value or the value determined by government authorities.

Agricultural Land in Urban Limits

If agricultural land falls within urban boundaries and is used for non-agricultural purposes (like commercial development or housing), it can also attract CVT. However, purely agricultural land in rural areas is usually exempt.

Motor Vehicles (in Some Cases)

According to recent finance bills, certain high-end vehicles above a specific engine capacity or luxury vehicles are subject to CVT. This typically applies when the vehicle exceeds a certain price threshold.

CVT on motor vehicles will be collected for 5 years and capture the additional revenue from high-end vehicles. The rate of CVT is 1% of the value of the motor vehicle. The tax only applies if the motor vehicle’s engine size exceeds 1300cc or the battery power capacity exceeds 50kWh if it’s an electric car.

Foreign Assets (As per the Latest Amendments)

Under recent amendments, Pakistani residents who hold foreign assets such as foreign real estate, offshore bank accounts, or shares in foreign companies are also subject to CVT.

If the value of the foreign asset is more than 100 million Pakistani rupees, then the owner will have to pay a 1% capital value tax at the time of filing an income tax return. The cost of foreign assets is calculated by converting the value with the exchange rate notified by SBP on the last day of the financial year. When one cannot determine the price accurately, a fair value is determined on the last day of the tax year, which will be used for this purpose.

This move aims to restrain tax evasion and bring offshore assets into the tax net.

Exemptions and Special Cases (Based on Current Laws)

- Inherited Property: Properties transferred through inheritance are usually exempt from CVT. If you inherit a property from a family member, you typically don’t have to pay Capital Value Tax on the transfer.

- Gift Transfers (Under Certain Conditions): Transfers of property as a gift to close family members, such as spouses, children, or parents, may be exempt from CVT. However, documentation must clearly reflect that it’s a genuine gift and not a disguised sale.

- Agricultural Land (Rural Areas): Pure agricultural land used for farming in rural areas typically does not attract CVT. This exemption is intended to protect farmers and the agricultural sector from additional taxation burdens.

- Low-Value Assets and Small Transactions: Properties or assets below a certain value threshold may be exempt from CVT, depending on provincial laws and the current year’s finance bill provisions. For example, small plots or properties in specific housing schemes for low-income groups might be exempt.

- First-Time Home Buyers (In Some Cases): Some provincial tax authorities offer concessions or exemptions for first-time homebuyers, particularly in government-subsidized housing schemes. These incentives aim to encourage home ownership among the middle and lower-income groups.

Capital Value Tax Rules and Regulatory Framework

The Capital Value Tax Rules are mentioned in the Finance Act of 2022. The Finance Act provides complete guidance on who is liable, how to declare the CVT, and the procedure of collection and payment.

The main aspects of the CVT rules and regulatory framework are:

- Electronic Declaration: You must declare all the assets online through the FBR’s IRIS portal. The process ensures transparency and accuracy in asset valuation.

- Payment of Refund: If the tax is recovered from a non-liable person or in excess, a refund can be applied through the Officer of Inland Revenue via Iris. The officer may request verification documents, and FBR will refund the payment upon approval.

- Right to Appeal: Dissatisfied persons can appeal orders passed by the Commissioner or Officer Inland Revenue and may revise orders after necessary inquiries. The appeals follow Section 127 of the Income Tax Ordinance, 2001.

- Tax Recovery Rules: Inland Revenue Officers can use power to recover unpaid Capital Value Taxes. Defaulters might have to pay additional charges due to delayed tax payments. Commissioners use current income tax recovery rules for CVT issues.

Impact of Capital Value Tax on Pakistan’s Real Estate Market

The real estate market is the most affected sector of Pakistan due to Capital Value Tax. As mentioned above, the taxes on land, houses, and buildings are 2% of the assessed property value. The CVT has significant implications for Pakistan’s real estate sector.

- Increased taxes reduce property demands, as they discourage transactions, particularly from non-filers

- Sellers avoid buying at higher prices to offset the tax burden, leading to declining property prices.

- The taxes also lead to a shift in buyer behavior. Buyers prefer dealing with filers to minimize tax liabilities, which eventually impact market activity.

Get Expert Help with Capital Value Tax and Asset Compliance Today!

If you’re feeling unsure about how Capital Value Tax applies to your property, vehicle, or foreign assets, let us help. Tax rules can get complicated, but you don’t have to figure them out yourself.

Our experts can walk you through the entire process, from understanding your liabilities to filing accurately. Whether it’s for a property transaction or foreign asset declaration, we’ll make it simple and hassle-free.

👉 Get Expert Tax Help or Call Us Now.