Builder Tax Calculator Pakistan 2025-2026

This is latest builder tax calculator as per 2025-2026 budget presented by Government of Pakistan.

| Commercial Buildings In Square Yard | |

| Annual Income Tax |

| Residential Buildings In Square Yard | |

| Annual Income Tax |

Pakistan Builder Tax Calculator

Welcome to the Pakistan Builder Tax Calculator

Our Pakistan Builder Tax Calculator is the latest tool for calculating the Builder Taxes in Pakistan for 2024-2025). This estimator is designed to simplify the process of estimating taxes on both commercial and residential properties. Developed in line with the 2024-2025 budget presented by the Government of Pakistan, this calculator allows you to input details such as the property size, location, and type to generate accurate tax estimations. Whether you’re dealing with commercial properties in Karachi, residential properties in Lahore, or any other region, our calculator provides a user-friendly interface for quick and precise calculations. Explore the features of this calculator to make informed decisions about your property taxes in accordance with the latest regulations.

Why Use the Builder Tax Calculator?

The Builder Tax Calculator serves as an essential tool for individuals and businesses engaged in the construction industry in Pakistan. Here’s why you should use the Builder Tax Calculator:

1. Precision in Tax Calculation

The calculator ensures accurate and precise calculations of taxes related to construction projects. By considering various factors such as property type, location, and area, it provides a reliable estimate of tax obligations.

2. Time Efficiency

Calculating taxes manually can be time-consuming and prone to errors. The Builder Tax Calculator streamlines the process, saving time and reducing the risk of mistakes. This efficiency is crucial for meeting project deadlines.

3. Adaptability to Property Types

The calculator allows differentiation between commercial and residential properties. This adaptability ensures that tax calculations are tailored to the specific characteristics of each property type, optimizing accuracy.

4. Location-Specific Insights

With the option to select the project location, the calculator provides insights into location-specific tax rates. This feature helps builders comply with regional tax regulations and incorporate accurate tax estimates into their financial plans.

5. Real-Time Scenario Analysis

Users can input different parameters in real-time and observe the immediate impact on tax calculations. This feature enables builders to perform scenario analyses, allowing for dynamic decision-making based on changing project details.

6. Versatility in Timeframes

Offering both yearly and monthly insights, the calculator accommodates the diverse financial planning needs of builders. This versatility ensures that builders can make informed decisions for both short-term and long-term project goals.

7. Mitigation of Compliance Risks

By providing accurate tax calculations, the calculator helps builders mitigate the risk of non-compliance. Adhering to tax regulations is crucial for avoiding penalties and maintaining a smooth construction process.

Features of Pakistan BuilderTax Calculator

We offer the following prominent features in our builder tax calculator:

1. Property Type Differentiation

The calculator allows users to distinguish between commercial and residential properties, enabling separate and accurate tax calculations for each type.

2. Location-Specific Tax Rates

Incorporates a location selection feature, allowing users to choose the city or urban area where the construction project is situated. This ensures precise calculation of taxes based on the specific tax rates applicable to that location.

3. Up-to-date Information

The calculator is designed to stay current with the latest tax regulations. It reflects updates from the most recent government budget, ensuring that users have access to accurate and up-to-date tax information.

4. User-Friendly Interface

Features a user-friendly interface that simplifies the input process. Users can easily enter property details, select options, and obtain instant calculations, enhancing overall usability and efficiency.

5. Real-Time Updates

Allows for real-time updates and adjustments to input parameters. Users can see instant changes in the calculated results as they modify property details or select different options, facilitating dynamic financial decision-making.

How To Fill Out This Builder Tax Calculator?

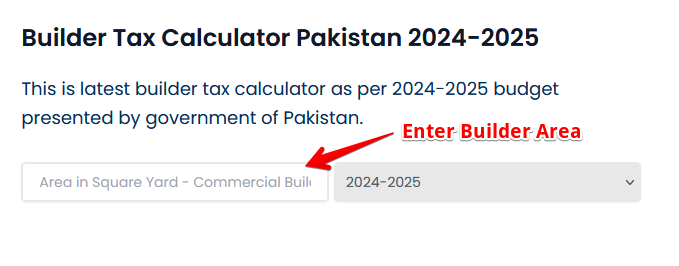

Filling out the Builder Tax Calculator involves inputting specific details related to your construction project.

To use the Builder Tax Calculator, follow these steps:

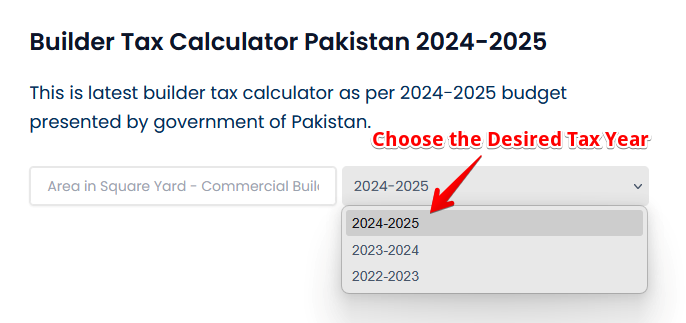

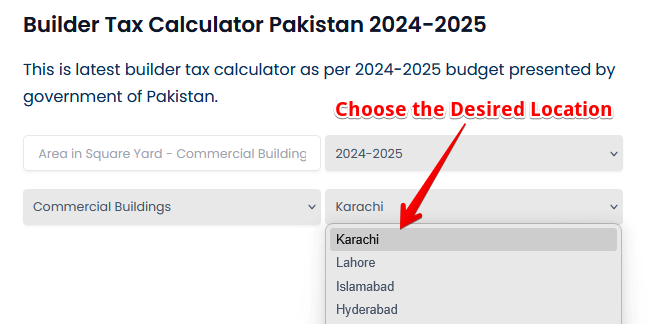

1. Choose the Tax Year – The calculator offers options for various years, including “2023-2024” and “2024-2025.” Pick the relevant year that corresponds to your business timeline.

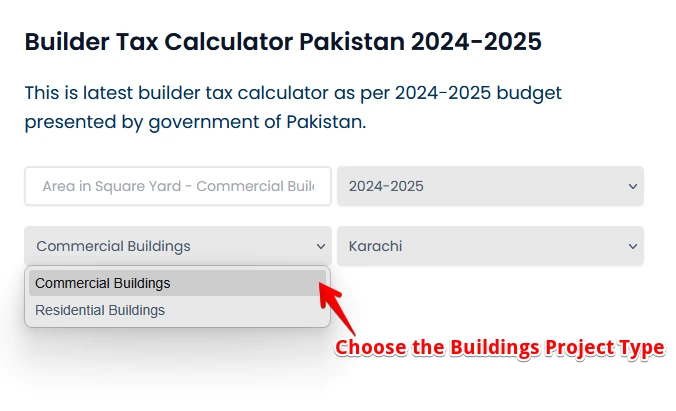

2. Choose Property Type – Choose the appropriate property type from the available options: either “Commercial Property” or “Residential Property.” Select the category that best aligns with your business.

3. Select Project Location – Use the “Select Location” dropdown menu to choose the city or urban area where your construction project is located. Different locations may have varying tax rates, and selecting the correct one ensures accurate calculations.

4. Enter Property Area – Depending on your selected property type, enter the area of the property in square feet.

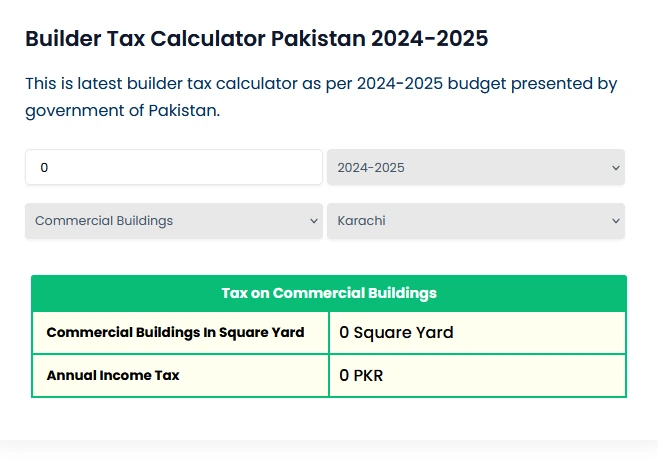

5. View Results – The calculator dynamically displays the calculated annual income tax, reflecting the input data provided.

Builder Tax Slabs in Pakistan 2024-2025

The Builder Tax calculator is designed to simplify the intricate process of calculating tax based on the Federal Budget 2024-2025 presented by the Government of Pakistan. Our tax slabs Pakistan are structured to ensure fairness and progression in the taxation system.

For Commercial Plots:

-

- List A Cities (Karachi, Lahore, Islamabad):

-

- Applied Tax Rate: Rs. 210/Sq Yd

-

- List A Cities (Karachi, Lahore, Islamabad):

-

- List B Cities (Hyderabad, Sukkur, Multan, Faisalabad, Rawalpindi, Gujranwala, Sahiwal, Peshawar, Mardan, Abbottabad):

-

- Applied Tax Rate: Rs. 210/Sq Yd

-

- List B Cities (Hyderabad, Sukkur, Multan, Faisalabad, Rawalpindi, Gujranwala, Sahiwal, Peshawar, Mardan, Abbottabad):

-

- List C Cities (Urban Areas not specified in A & B):

-

- Applied Tax Rate: Rs. 210/Sq Yd

-

- List C Cities (Urban Areas not specified in A & B):

For Residential Plots:

List A Cities (Karachi, Lahore, Islamabad):

-

- Tax Rate Applied According to Sq Yd:

-

- Up to 120 Sq Yd: Rs. 20

-

- 121 to 200 Sq Yd: Rs. 40

-

- 201 and more Sq Yd: Rs. 70

-

- Tax Rate Applied According to Sq Yd:

List B Cities (Hyderabad, Sukkur, Multan, Faisalabad, Rawalpindi, Gujranwala, Sahiwal, Peshawar, Mardan, Abbottabad):

-

- Tax Rate Applied According to Sq Yd:

-

- Up to 120 Sq Yd: Rs. 15

-

- 121 to 200 Sq Yd: Rs. 35

-

- 201 and more Sq Yd: Rs. 55

-

- Tax Rate Applied According to Sq Yd:

List C Cities (Urban Areas not specified in A & B):

-

- Tax Rate Applied According to Sq Yd:

-

- Up to 120 Sq Yd: Rs. 10

-

- 121 to 200 Sq Yd: Rs. 25

-

- 201 and more Sq Yd: Rs. 35

-

- Tax Rate Applied According to Sq Yd:

Note:

-

- The tax rates mentioned above are applicable per square yard for residential plots in the specified cities.

-

- The categorization into List A, List B, and List C is based on the city classification provided.

-

- The tax rates vary depending on the size of the residential plot, with different slabs for areas up to 120 Sq Yd, 121 to 200 Sq Yd, and 201 Sq Yd and above.

Understanding these slabs is vital for accurate tax estimation and informed financial planning, ensuring compliance with Pakistan’s tax regulations.

How Our Builder Tax Calculator Ensures Security?

Our Builder Tax Estimator places a high emphasis on safeguarding your privacy and security. It is engineered to function without requiring sensitive personal information, such as your name, national identity card number, address, or bank account details. Be assured that we neither store nor record any data you input into the provided fields.

Rest assured, all financial information is treated with the utmost confidentiality and is not shared with third parties.

For additional guidance on protecting yourself from scams, please consult the Tax Scams and Consumer Alerts guidelines. Your trust and privacy are our foremost priorities as we assist you in navigating the intricacies of income tax estimation in Pakistan.

Support and Contact Information

For any inquiries, assistance, or personalized support, please do not hesitate to contact our dedicated support team. Our experts are ready to help you navigate through any challenges or questions you may have.

Contact Email: [help@paktaxcalculator.pk]

We value your feedback and are committed to ensuring a seamless experience with the Builder Tax Calcul