| Annual Income | |

| Tax Deducted | |

| Income After Tax | |

Pakistan Supply of Goods Tax Calculator

Managing taxes for your business shouldn’t feel complicated when it comes to the Supply of Goods. With changing tax slabs, multiple business categories, and ATL vs non-ATL distinctions, figuring out the exact tax can become time-consuming for business owners. Pak Tax Calculator’s Supply of Goods Tax Calculator is your go-to tool for estimating withholding tax on the supply of goods under Section 153 of the Income Tax Ordinance 2001.

The innovative Pak Tax Calculator is engineered to provide instant, precise calculations for tax deductions covering every defined business category, from FMCG, AOPs, and individual toll manufacturers to local yarn supplies, pharmaceuticals, fertilizers, electronics, rice, cottonseed, and edible oil.

Relying on manual tables and generic percentage estimates can lead to expensive mistakes. Pak Tax Calculator’s Supply Goods Tax Calculator ensures you remain compliant and gain a clear view of your Income After Tax.

What is The Supply of Goods Tax in Pakistan?

The Supply of Goods Tax is a withholding tax deducted at the time of supplying goods, as defined under the Income Tax Ordinance 2001. In simple words, if you supply goods and receive payment from a registered buyer, a percentage of that payment is withheld as tax and deposited with the FBR. The tax is treated as advance income tax, which is adjustable at the time of filing your annual tax return.

The tax rate varied based on:

- Your Active Taxpayer List status

- Types of goods supplied

- Your business/legal structure

- The category of buyer deducting tax

The Supply of Goods Tax is applicable on:

- Traders

- Retailers and Wholesalers

- Manufacturers

- Tool manufacturers

- Importers supplying goods locally

- Individuals or AOPs selling goods commercially

- Companies supplying goods to registered entities

Features of the Supply of Goods Tax Calculator Pakistan

Pak Tax Calculator’s supply of Goods Tax Calculator is created to save your time, reduce errors, and give you clarity on how much tax applies in any supply transaction.

Accurate Calculations

We follow the official FBR tax slabs and apply the correct percentage based on your selected category. Moreover, the Supply of Goods Tax Calculator also distinct between ATL and non-ATL status. This guarantees that the tax deducted is precise, ensuring full compliance.

Up-to-Date Tax Slabs

Tax laws in Pakistan are dynamic; tax rates can change with every finance bill or mini-budget. Pak Tax Calculator is continuously updating its calculations to provide accurate results for the Supply of Goods Tax for the 2025-2026 fiscal year. So, use this calculator with complete peace of mind that you’ll always get the correct numbers.

User-Friendly Interface

Just like every calculator in Pak Tax Calculator, the Supply of Goods Tax Calculator is simple, clean, fast, and designed to work instantly without confusing fields or technical jargon. You will receive immediate, precise results, eliminating the complexity typically associated with calculating Withholding Tax (WHT)

Free to Use (No Registration Required)

In our commitment to supporting national tax compliance, the Pakistan Supply of Goods Tax Calculator is offered free of charge, with no registration or subscription required. This allows any individual, AOP, or Private Limited Company to access accurate tax data instantly.

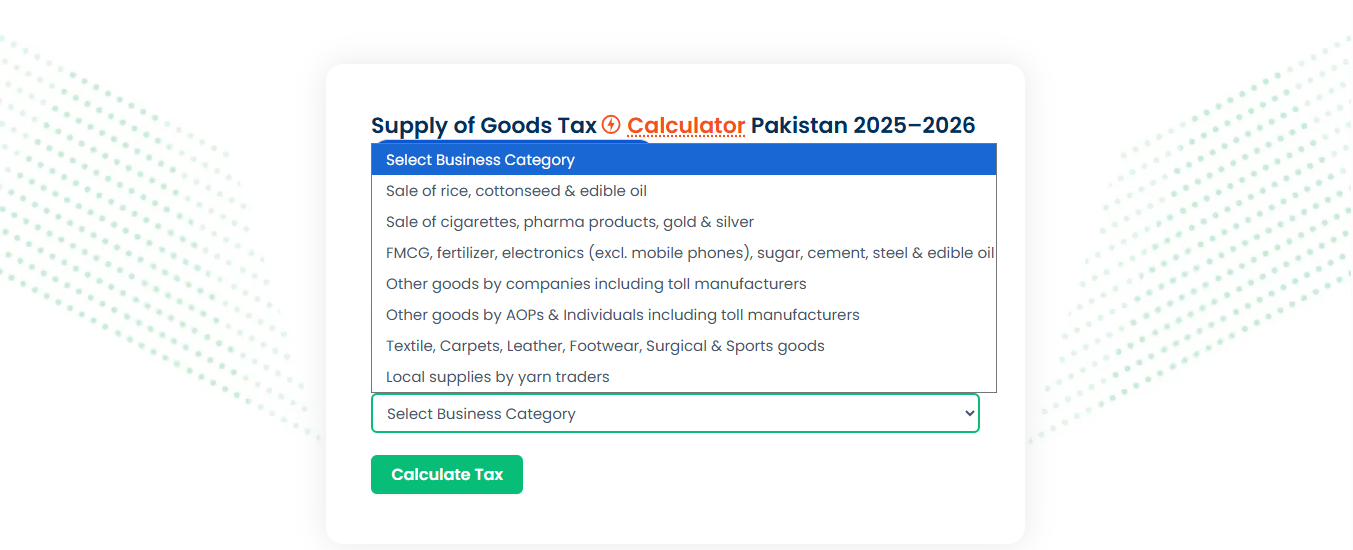

Distinguishing Goods Types

Our calculator provides a comprehensive drop-down menu that allows users to select their exact business category (e.g., FMCG, yarn traders, textile manufacturers). These features are vital as different types of goods have different rates, providing accuracy where generic tools would fail.

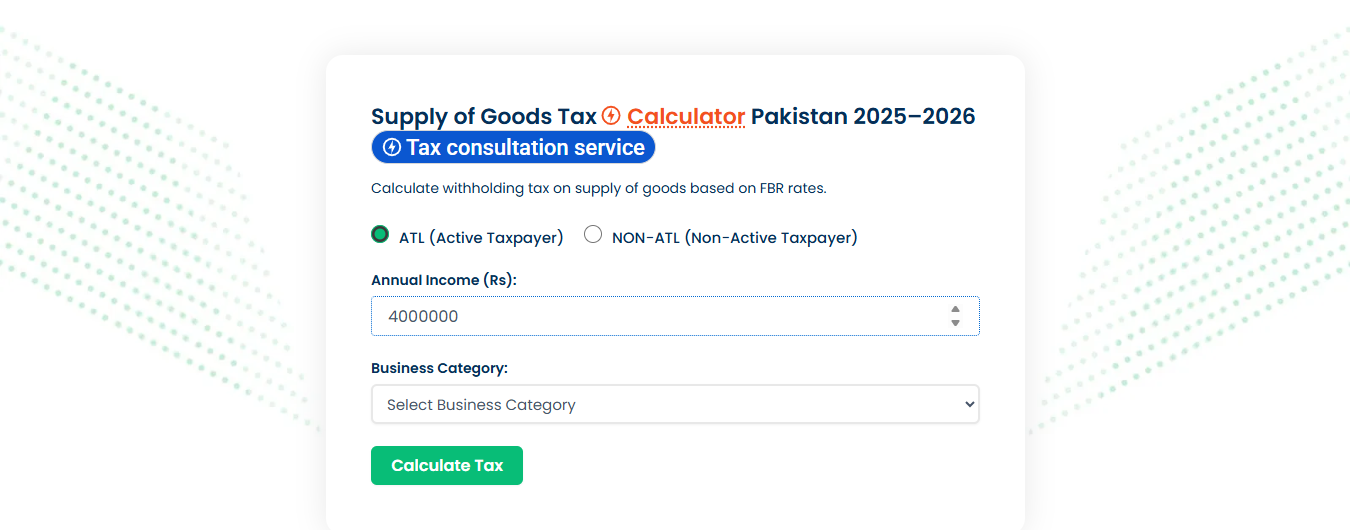

How to Fill Out the Supply of Goods Tax Calculator?

Using the calculator is quick and simple, designed to eliminate errors and complexity:

1. Select Your Filer Status: Choose whether the recipient of the payment is an Active Taxpayer List (ATL) member or a Non-Active Taxpayer (non-ATL). This step is crucial because it determines whether the standard or the double penalty rate applies.

2. Enter the Amount: Input the annual income received or receivable for the supply of goods.

3. Choose Business Category: From the drop-down menu, choose your business type. It is an essential step as different business categories have different tax rates.

4. Click Calculate, and the Pak Tax Calculator will show your Annual Income, Tax Deducted, and Income After Tax.

How Does Our Supply of Goods Tax Calculator Work?

This calculator uses the tax slabs finalized by the Government of Pakistan. The supply of goods tax rate changes for the different categories of goods and the taxpayer type (usually for the Non-ATL taxpayer type).

Let’s understand how our Supply of Goods Tax Calculator works:

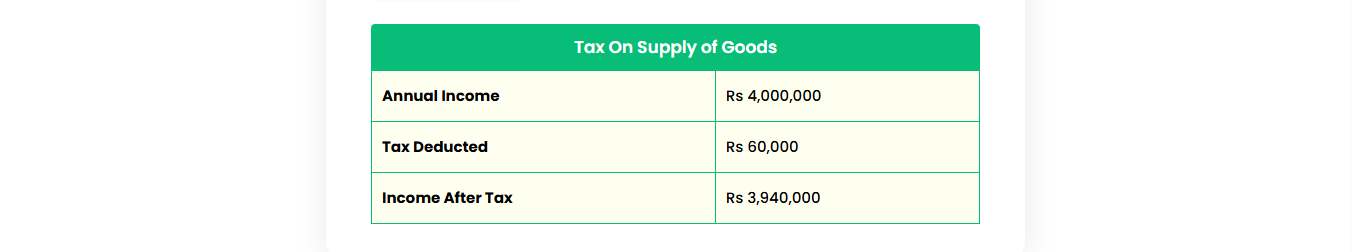

You are a rice seller on the Active Taxpayer List who made a net profit of 4,000,000 (4 million). According to the FBR tax slabs, the tax rate is 1.50%. So, the net profit is 4 million, and the category is Rice; the tax will be 60,000.

The process is pretty simple mathematically. Just multiply the net profit by the tax rate, and you will find your tax liability.

Net Profit x Tax Rate = Tax Liability

4000000 x 1.5% = 60,000

Supply of Good Tax Slabs & Latest Updates (2025-26)

Business Category | ATL Rate | Non-ATL Rate |

Sale of Rice, Cottonseed, & Edible Oil | 1,50% | 3.00% |

Sale of Cigarettes, Pharma Products, Gold & Silver | 1.00% | 2.00% |

FMCG, Fertilizer, Electronics (exclusive of mobile phones), Sugar, Cement, Steel & and Edible Oil | 0.30% | N/A |

Other Goods by Companies, Including Toll Manufacturers | 10% | 20% |

Other Goods by AOPs & Individuals, Including Toll Manufacturers | 5.50% | 11% |

Textile, Carpets, Leather, Footwear, Surgical & Sports Goods | 1.00% | 2.00% |

Local Supplies by Yarn Traders | 0.50% | 1.00% |

Note: The Supply of Goods Tax is only applicable if the annual income is more than PKR 75,000

How Our Supply of Goods Tax Calculator Ensures Security?

We know that where money or tax tools are involved, data protection and user confidence are not negotiable. That is why we have made transparent and proactive efforts to keep your details secure, private, and impenetrable at all times.

- No Collection of Personal Data: Our calculator is designed to run without requiring any personal or sensitive details such as CNIC, NTN, Phone number, contact information, or login credentials.

- Secure Data Transmission (HTTPS/SSL): All communication between your browser and our website is encrypted using industry-standard HTTPS and SSL protocols. The layers safeguard interception from unauthorized third parties.

- Focus on Calculation, Not Collection: Pak Tax Calculator is a utility tool, not a data collection tool. We don’t need account creation or personal registration to make use of the calculator.

- Regular Security Updates: We are constantly working to enhance security. Our developers follow best practices for web security, continually reviewing code, infrastructure, and third-party integrations, and resolving potential vulnerabilities.

Our Supply of Goods Tax Calculator is designed to be a secure, private, and reliable platform for estimating tax. You can trust us to make informed financial decisions without concern about privacy.

Support and Contact Information

For any inquiries, assistance, or personalized support, please do not hesitate to contact our dedicated support team. Our experts are ready to help you navigate through any challenges or questions you may have.

Contact Email: [help@paktaxcalculator.pk]

We value your feedback and are committed to ensuring a seamless experience with the capital gain on securities tax calculator.