Withholding on Income from Properties Tax Calculator Pakistan 2024-2025

This is latest builder tax calculator as per 2024-2025 budget presented by Government of Pakistan.

| Annual Rent of Immoveable Property - Individual / AOP as Owner | |

| Advance given to be added in Owner's Rental Income | |

| Taxable Amount | |

| Annual Income Tax | |

| Income Tax to be Deducted at the time of Monthly Payment |

Withholding Tax on Income from Properties

Welcome to the Withholding Tax Calculator on Property Income

Our Withholding Tax on Property Income Calculator is your reliable tool for navigating the complexities of rental income taxation in Pakistan. Designed to simplify the calculation of withholding tax under Section 155 of the Income Tax Ordinance, this user-friendly calculator helps both tenants and landlords ensure accurate compliance with the FBR’s rules.

Whether you have rental or commercial properties, or you’re a non-resident individual with rental income in Pakistan, our website offers you a simple and quick way of estimating your withholding tax liability. Keep yourself up-to-date with tax planning, avoid costly penalties, and stay compliant easily through the Withholding Tax on Income from Property Calculator.

Understanding Withholding Tax on Income from Properties (Section 155)

Withholding Tax (WHT) on rent income is an advance tax withheld at source by the tenant or paying party upon payment of rent. The system is utilized by the Federal Board of Revenue (FBR) to implement taxation at source and facilitate timely revenue realization from rental properties throughout Pakistan.

The tax withholding is discussed in Section 155 of the Income Tax Ordinance, 2001. It mandates the deduction of tax on the rent of immovable property. The tax is particularly imposed on the income derived from renting out buildings, land, or any other immovable property. In contrast to Capital gains Tax or Stamp duty, WHT on property income focuses directly on the regular rental income.

Key Features of Our Withholding Tax Calculator

Our calculator isn’t just a basic tool; it’s engineered with features specifically tailored for the Pakistani tax landscape.

1. Real-Time Calculation

Get instant results with just a few inputs—monthly rent, tenant type, and filer status. The calculator processes your information in real time and delivers a reliable estimate of the tax to be withheld and deposited.

2. FBR Rate Adherence

Our software is updated to incorporate the newest 2025-26 official FBR tax rates, thresholds, and rules for Section 155 of the Income Tax Ordinance, 2001. You can be assured that your calculations are always made in accordance with the most up-to-date legal provisions to ensure accuracy and compliance.

3. User-Friendly and Mobile Responsive

Designed for convenience, our calculator is lightweight, intuitive, and compatible with both desktop and mobile devices. Whether you’re filing taxes from your laptop or calculating rent deductions on the go, the tool performs seamlessly across all devices.

4. Intelligent Threshold-Aware Logic

The calculator smartly integrates the minimum rent thresholds of income imposed by the FBR that determine when WHT becomes applicable. It accurately factors the varying limits, such that tax is calculated and shown only when the law mandates it, avoiding unnecessary deductions.

5. No Registration Required

Pak Tax Calculator is completely free to access, with no registration or collection of personal information, ensuring that it’s secure, safe, and anonymous to provide you with clarity on your tax situation. You won’t be required to provide CNIC numbers, NTN, or sensitive data – simply enter your details, and instant results are ready.

Why You Should Use the Withholding Tax Calculator for Rental Property Income

The calculator is not just a complicated tool; it’s a decision-making companion for anyone dealing in Pakistan’s property rental sector. Pak Tax Calculator offers valuable strategic, practical, and financial benefits to both property owners and tenants.

1. Take Control of Your Financial Planning

Withholding tax is a monthly recurring expense for tenants and an important consideration for landlords. With accurate monthly and annual taxation projections, you will have a better understanding of net returns and liabilities. You are either a salaried tenant or an investor in real estate, with clarity and accuracy, smarter financial projections, and budgeting.

2. Ensure Compliance with Pakistani Tax Laws

FBR’s imposition of enforcement on rental income has increased considerably. They regularly track property transactions; in such cases, our calculator assists tenants in complying with legal requirements by providing information as per Section 155. We reduce the risk of misreporting, underreporting, or delayed filings, leading to heavy fines and audits.

3. Avoid Errors and Overpayments

Manual tax calculations for rentals often overlook tiered rate structures, tax law changes, and applicability across diverse tenant profiles. Pak Tax Calculator reduces these hazards by pre-coding all rules and logic that are legally sound. It avoids overpaying, reduces disputes between tenants and landlords, and facilitates accurate reporting for both parties.

4. Save Time for Tenants, Landlords, and Consultants

Our calculator substitutes the old manual tax calculation methods, which include the use of sheets, FBR tables, or costly consultancy services. The Pak Tax Calculator provides instant results in seconds and presents clear, readable, and understandable information for non-technical users. The calculator is ideal for busy landlords managing multiple properties and tenants who require transparency before paying rent.

How to Use Withholding Tax on Income from Properties

Follow these steps to complete the calculator.

1. Select the right business entity – Choose from two options: Individual/AOP and Company. Ensure you select the correct entity, as it impacts the applicable tax rates.

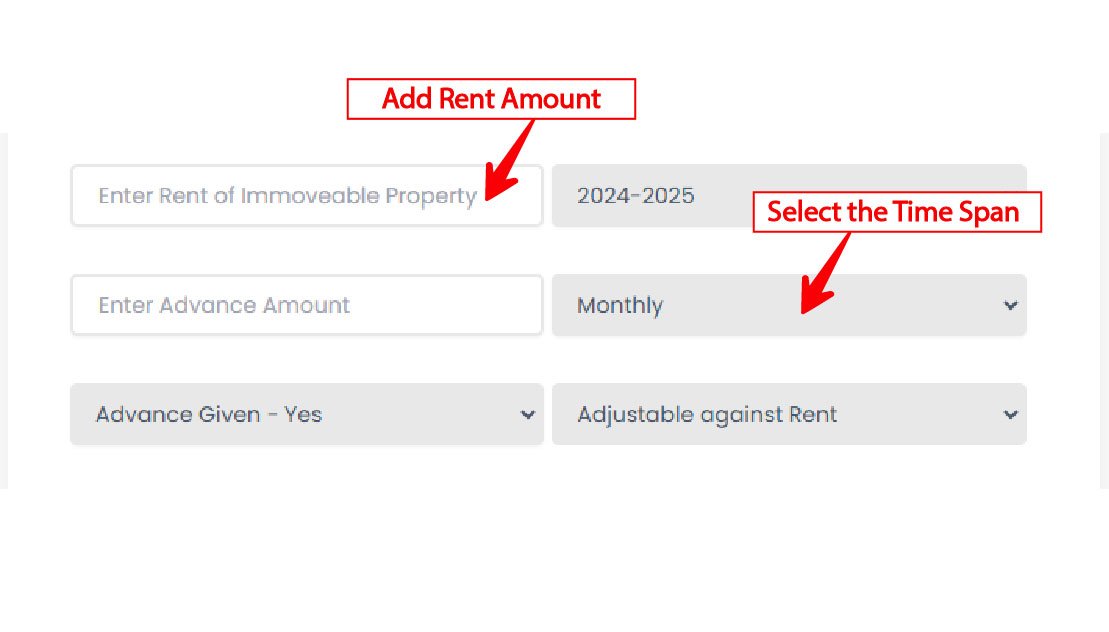

2. Enter rental income from your property – Add the amount you received from the tenants. The rent can be paid monthly, quarterly, biannually, or annually. Ensure you select the correct period from the drop-down menu.

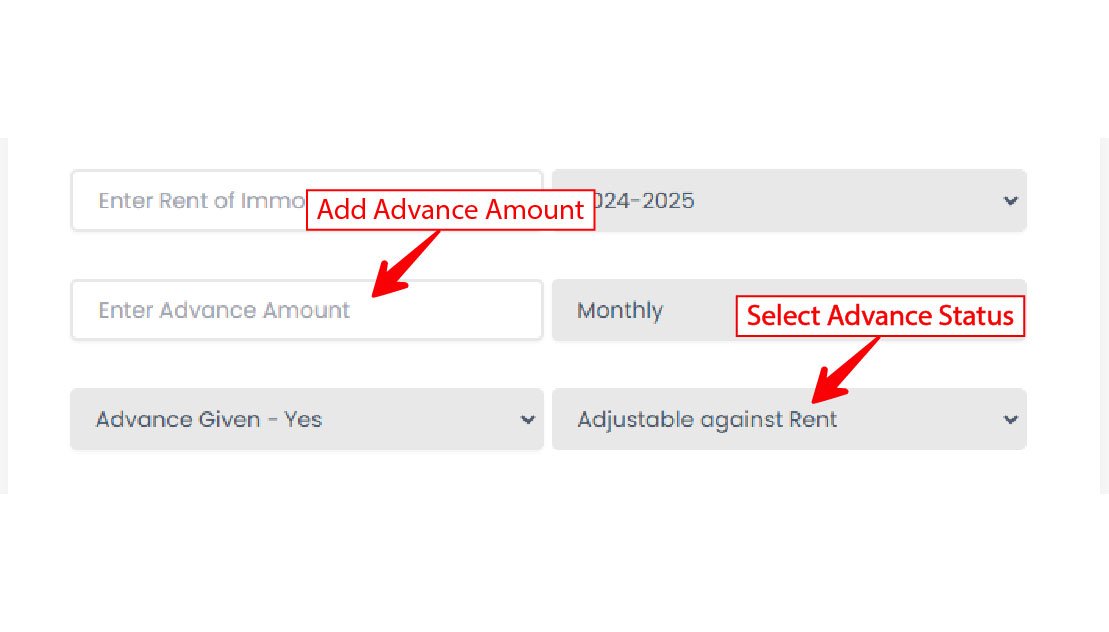

3. Enter the advance amount – In the second field, mention the advance you have received from the renter and select whether the advance is adjustable with rent or refundable to the tenant. If refundable, the tax liability can be reduced.

4. View Results – The calculator will automatically display the calculated withholding tax based on the given inputs.

Withholding Tax on Income from Properties Slab in Pakistan 2025-26

Withholding tax is deducted at the source by tenants and deposited to the Federal Board of Revenue (FBR) before the 15th of next month. The applicable WHT rates for individuals in the tax year 2025-26 are:

|

Annual Rent (PKR) |

Filer’s Tax Rate |

Non-Filer’s Tax Rate |

|

Up to 300,000 |

Exempt |

Exempt |

|

300,001 – 600,000 |

5% on above 300,000 |

10% on above 300,000 |

|

600,001 – 2,000,000 |

15,000 + 10% |

30,000 + 20% |

|

Above 2,000,000 |

155,000 + 25% |

310,000 + 50% |

The FBR has also outlined tax rates applicable to companies that receive income from the rent of immovable property.

Companies that are on the Active Taxpayer List (ATL) will be subject to a flat 15% withholding tax on rental income. However, if you are not on the ATL, you will face double the rate, which is 30% of the rental income.

Exemptions and Exclusions

Although withholding tax on property income is generally applicable, certain exemptions can be availed of under specific circumstances.

- Income less than the minimum threshold, which is 300,000, according to the FBR notifications.

- Diplomatic properties, trusts, waqf, NGOs, and educational institutions could be exempt under certain provisions of the Income Tax Ordinance.

- Payments made by some government agencies could be exempted from withholding tax on property income.

It is better to check the latest FBR notifications or consult a tax expert to decide whether your income is exempt or not.

How Pak Tax Calculator Provides Data Safety and Integrity?

We know that where money tools, particularly tax tools, are involved, data protection and user confidence are not negotiable. That is why we have made transparent and proactive efforts to keep your details secure, private, and impenetrable at all times.

- No Collection of Personal Data: Our calculator is designed to run without requiring any personal or sensitive details, such as CNIC, NTN, phone number, contact information, or login credentials. You just put in simple, non-identifying inputs, and the calculator gives you outcomes. Additionally, the calculations are done in real-time according to your temporary inputs, which are deleted once you close or reload the page.

- Secure Data transmission (HTTPS/SSL): All communication between your browser and our website is encrypted with industry-standard HTTPS (Hypertext Transfer Protocol Secure) and SSL (Secure Sockets Layer) layers of protocol. The layers safeguard interception from unauthorized third parties.

- Focus on Calculation, Not Collection: Pak Tax Calculator is a utility tool, not a data collection tool. We don’t need account creation or personal registration to make use of the calculator.

- Regular Security Updates: We continually enhance security. Our developers use the best practices for web security, constantly reviewing the code, infrastructure, and third-party integrations and resolving possible vulnerabilities in a timely manner to ensure the security and integrity of Pak Tax Calculators

Your privacy is our concern. Our withholding tax on income from properties calculator is designed to be a secure, private, and reliable facility for estimating tax. You can trust yourself to make educated financial decisions without fear of privacy issues.

FAQs

Do NRPs (non-resident Pakistanis) pay withholding tax?

They are liable to withholding tax on property income. Nevertheless, NRPs may be exempted from WHT if they are eligible for a Double Taxation Treaty with the residence country.

How can I check that WHT has been paid in?

You can verify the deposit through the FBR Iris portal by checking your tax ledger. Another option is to request the WHT statement or certificate to verify the deposit. The certificate serves as proof of tax paid and provides the basis for claiming credit against the final tax liability.

What type of properties are subject to WHT from their income?

Withholding tax on rentals of properties is charged on rent received for any of the immovable assets, such as:

1. Residential Property: Apartments and houses

2. Commercial Property: Industrial units, warehouses, offices, and shops

3. Agricultural Land: If rented for purposes other than actual agricultural activity by the owner of the land.

Is WHT required when rent is paid in advance or arrears?

Yes, withholding tax is enforceable at the payment of rent, whether it is paid in advance or arrears. The obligation to deduct is where the payment is made or credited, whichever is earlier, in respect of property income.

Support and Contact Information

For any inquiries, assistance, or personalized support, please do not hesitate to contact our dedicated support team. Our experts are ready to help you navigate through any challenges or questions you may have.

Contact Email: [help@paktaxcalculator.pk]

We value your feedback and are committed to ensuring a seamless experience with the Gain Tax on Mutual Fund Tax Calculator.