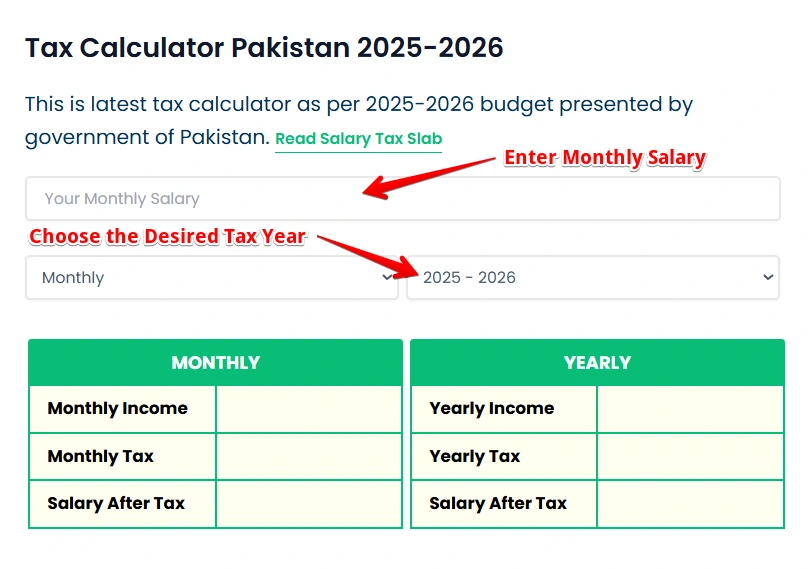

Tax Calculator Pakistan 2025-2026

This is latest tax calculator as per 2025-2026 budget presented by government of Pakistan.

| Monthly Income | |

| Monthly Tax | |

| Salary After Tax |

| Yearly Income | |

| Yearly Tax | |

| Salary After Tax |

| Monthly Income | |

| Monthly Tax | |

| Salary After Tax |

| Yearly Income | |

| Yearly Tax | |

| Salary After Tax |

Pakistan Salary Tax Calculator

Welcome to the Pakistan Income Tax Calculator

Gain valuable insights into your potential income tax liability with our user-friendly salary calculator. Whether you’re planning your finances or simply curious about your tax obligations, this tool provides a quick estimate based on your monthly & yearly salary and the selected tax year. Our Pakistan Salary Tax Calculator offers precise and up-to-date tax calculations for individuals in Pakistan. With our easy interface, effortlessly calculate your income tax based on the latest tax slabs and rates. Input your salary, choose the applicable tax year, and watch as the calculator provides a breakdown of monthly and yearly tax amounts.

Why Use the Salary Tax Calculator?

The Salary Tax Calculator Pakistan is a valuable tool for anyone needing quick, accurate, and personalized tax calculations in Pakistan. Here is why should you choose the estimator to calculate tax on salary in Pakistan:

1. Simplicity and Convenience

Calculating income tax can often be complex and time-consuming, especially when dealing with various tax slabs and regulations. The Salary Income Tax Estimator simplifies this process, providing a user-friendly interface that makes it easy to input your salary details and get instant calculations.

2. Accuracy and Up-to-Date Information

Our calculator is regularly updated to reflect the latest tax laws and slabs as per the Federal Board of Revenue (FBR) in Pakistan. This ensures that the calculations are accurate and compliant with current regulations, reducing the risk of errors that can occur with manual calculations.

3. Personalized Calculations

Whether you are a salaried employee or a business owner, the calculator allows for personalized calculations. You can input specific details like your salary range, deductions, and exemptions to get a tailored estimate of your tax liability.

4. Helpful for Financial Planning

Knowing your tax liability in advance is crucial for effective financial planning. The calculation tool provides you with a clear picture of your tax commitments, helping you to budget accordingly and make informed financial decisions.

5. Assists in Compliance

Staying compliant with tax regulations is essential. The estimator aids in this by providing accurate tax calculations, ensuring that you are paying the right amount of tax, and avoiding any legal issues related to non-compliance.

6. Resourceful for Multiple Scenarios

The estimator is versatile and can be used to calculate taxes in various scenarios – whether you’re evaluating a job offer, planning a salary negotiation, or simply checking your tax obligations. It provides a quick way to understand the impact of different salary levels on your tax liability.

7. Free and Accessible

The Salary Income Tax calculator is freely accessible online, making it a convenient tool for everyone, from individual taxpayers to financial professionals. There’s no need for specialized software or tools – just access the tool from any device with internet connectivity.

Features of Pakistan Salary Tax Calculator

We offer the following prominent features in our salary tax calculator:

1. Comprehensive Tax Slabs

Get detailed information on tax rates for various income ranges for the tax year 2025-2026. Whether your annual income is Rs. 600,000 or above Rs. 6,000,000, our calculator has you covered with accurate tax rate applications.

2. Monthly and Yearly Tax Breakdown

Understand your tax obligations on both a monthly and yearly basis. Simply input your salary, and our calculator will do the rest.

3. Easy to Use

Navigate through our calculator with ease. Whether you’re an individual taxpayer, an employer, or a payroll manager, our tool is designed for everyone.

4. Advanced Features

Adjust the calculator to your specific needs. Enter your income based on different periods like monthly, weekly, or hourly wages, and consider factors like age, number of dependents, and more for a tailored experience.

5. Stay Informed

Access informative content on tax filing deadlines, tax return processes, and answers to frequently asked questions about income tax in Pakistan.

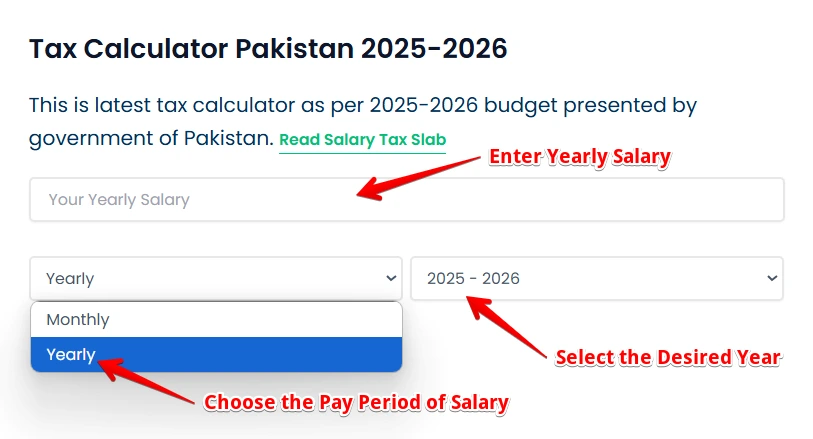

How To Fill Out This Salary Income Tax Calculator?

Discover how to effortlessly complete this Salary Income Tax calculations. Enter monthly salary, choose the tax year, and follow the clear instructions. Quickly gain insights into your estimated annual tax liability and post-tax salary.

To use the Salary Tax Calculator, follow these steps:

1. Monthly Salary Input – Enter monthly salary in the “Your Monthly Salary” input field. Select the appropriate fiscal year from the dropdown menu.

2. Yearly Salary Input – Alternatively, you can input yearly salary by selecting the “Yearly” option in the “Salary Period” dropdown.

Enter yearly salary in the “Your Yearly Salary” input field. Select the appropriate fiscal year from the dropdown menu.

3. View Results – The calculator provides a breakdown of monthly and yearly income, monthly tax, yearly tax, and salary after tax.

Income Tax Slabs in Pakistan 2025-2026

The salary Tax calculator is designed to simplify the intricate process of calculating income tax based on the Federal Budget 2025-2026 presented by the Government of Pakistan. Our income tax slabs Pakistan are structured to ensure fairness and progression in the taxation system.

-

- Where the taxable yearly income does not exceed Rs. 600,000, the rate of income tax is 0%.

-

-

- Where the taxable yearly income exceeds Rs. 600,000 but does not exceed Rs. 1,200,000, the rate of income tax is 1% of the amount exceeding Rs. 600,000.

-

- Where the taxable yearly income exceeds Rs. 1,200,000 but does not exceed Rs. 2,200,000, the rate of income tax is Rs. 6,000 plus 11% of the amount exceeding Rs. 1,200,000.

-

-

- Where the taxable yearly income exceeds Rs. 2,200,000 but does not exceed Rs. 3,200,000, the rate of income tax is Rs. 116,000 plus 23% of the amount exceeding Rs. 2,200,000.

-

-

-

- Where the taxable yearly income exceeds Rs. 3,200,000 but does not exceed Rs. 4,100,000, the rate of income tax is Rs. 346,000 plus 30% of the amount exceeding Rs. 3,200,000.

-

-

- Where the taxable yearly income exceeds Rs. 4,100,000, the rate of income tax is Rs. 616,000 plus 35% of the amount exceeding Rs. 4,100,000.

Understanding these slabs is vital for accurate tax estimation and informed financial planning, ensuring compliance with Pakistan’s tax regulations.

How Our Income Tax Calculator Ensures Security?

Our Salary Income Tax Estimator prioritizes your privacy and security. It is designed to operate without requesting sensitive personal information such as name, national identity card number, address, or bank account details. Rest assured, we do not store or record any data you input into the fields.

Financial information is treated with the utmost confidentiality and not shared with third parties.

Please refer to Tax Scams and Consumer Alerts guidelines for additional guidance on safeguarding yourself from scams. Your trust and privacy are our top priorities as we assist you in navigating the complexities of income tax estimation in Pakistan. Your trust and privacy are our top priorities as we assist you in navigating the complexities of income tax estimation in Pakistan.

Support and Contact Information

For any inquiries, assistance, or personalized support, please do not hesitate to contact our dedicated support team. Our experts are ready to help you navigate through any challenges or questions you may have.

Contact Email: [ help@paktaxcalculator.pk ]

We value your feedback and are committed to ensuring a seamless experience with the Salary Tax Calculator.