Whether you are going to file your taxes, start a business, or just want to remain compliant with the nation’s tax laws, obtaining a National Tax Number (NTN) is the first step that one has to take. The NTN (or National Tax Number) is a vital aspect of the Pakistan tax process, and helps businesses and individuals fulfill their tax obligations as well as apply for government services. Mandatory for all persons involved in taxable transactions, the FBR-issued number is a leading tool in promoting good governance and tax adherence.

But, like so many bureaucratic things in Pakistan, the process to get your NTN can seem confusing, particularly if you are doing it for the first time. Which documents do you need? Should you apply online or visit the tax office? How long does it take? All these questions come up.

In this guide, we will explain the whole process, explaining all the required steps and documents for getting an NTN number in Pakistan.

What is NTN (National Tax Number)?

The Federal Board of Revenue provides a distinctive identification number called the National Tax Number (NTN) that serves as an identity number that is necessary for any individual who wants to interact with the tax process. The number is needed for monetary transactions in the country, including the filing of income tax returns, opening an account, bidding on government tenders, and purchasing properties. The number is essential in facilitating compliance with tax laws of Pakistan and can be a helpful tool in streamlining tax matters.

So, who should have a National Tax Number? Simply put, any person or business earning taxable income should have an NTN. Here are the entities that must have an NTN.

- Salaried individuals

- Sole Proprietor

- Single Business Owner

- Association of Persons (AOP)

- Limited Liability Partnership (LLP)

- Incorporations

- Non-Governmental Organization (NGO)

- International Non-Governmental Organization (INGO)

- Freelancers

Remember, having an NTN legitimizes your financial activities and gives you a filer status.

NTN in Pakistan is completely free and can be acquired online or manually at a Regional Tax Office.

How to Obtain a National Tax Number Online Through the FBR IRIS Portal

Here is a step-by-step guide on how to get a free National Tax Number online via the IRIS 2.0 portal:

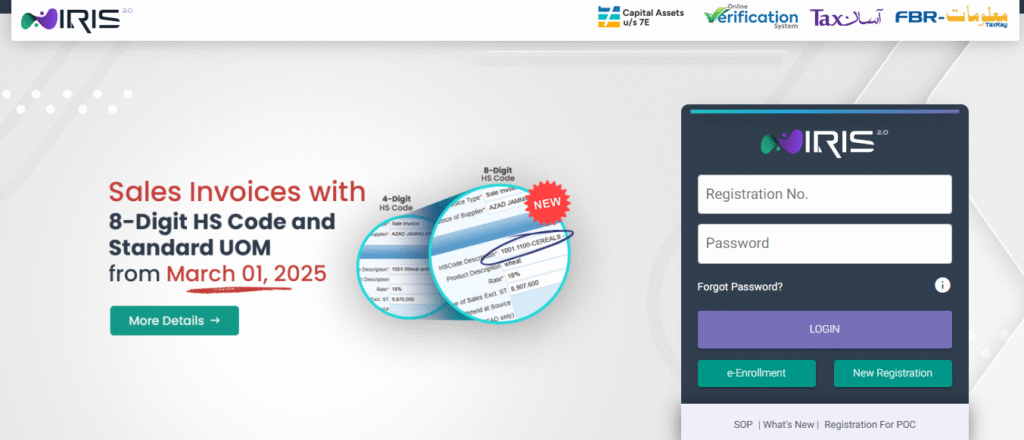

1. Create an Account on IRIS Portal

Visit the IRIS 2.0, on this screen, you will see some branding and a log-in form.

At the bottom right section of the form, you will see two buttons, “e-Enrollment” and New Registration”. Click “New Registration” to begin the process.

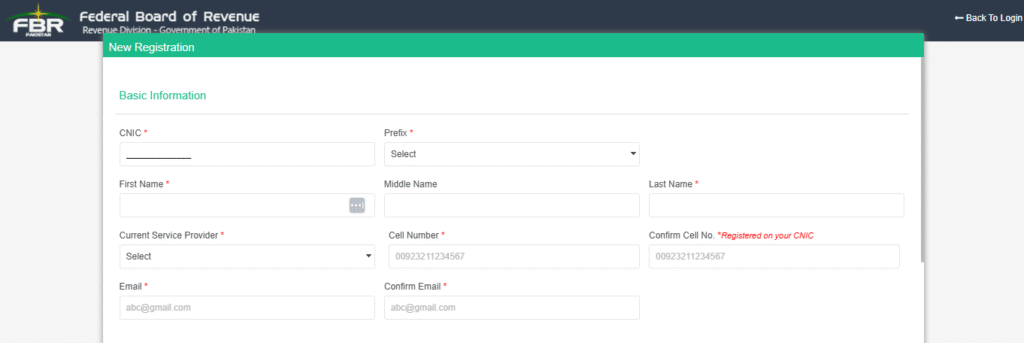

2. Enter Basic Information

It will open the new registration process, where you will add the required information.

The first phase involves providing basic information, which includes CNIC, Name, SIM service provider, cell phone number, and email address. You will need to confirm the cell phone number and email address again. We recommend adding the mobile number that is registered to your CNIC.

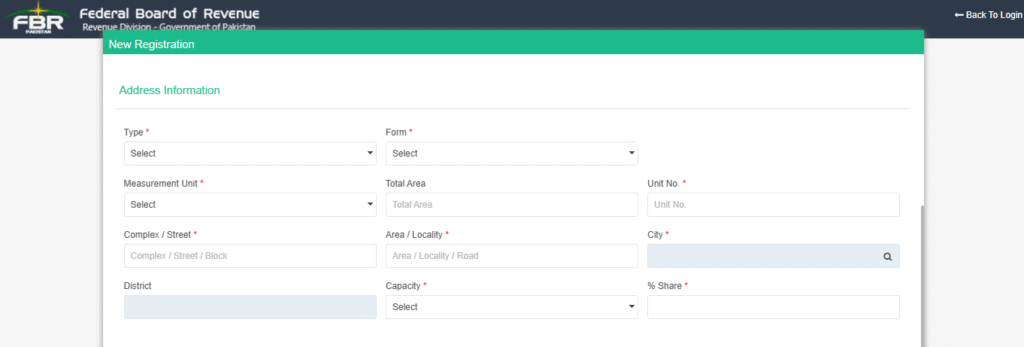

3. Enter Address Information

In the second part of the new registration form, you will have to add the address and house information.

The form requires the following information

- Type and form of property. The type of property is residential, agricultural, or commercial and the form further explains the property. For example, Farm, Land(irrigated), Land(uncultivated), Nursery, etc, are forms of agricultural property.

- Then you will select the measurement unit and mention the area.

- Now, the form requires house address, so you will provide Unit No, Complex/Street, Area/Locality, City, and District.

- Lastly, select the capacity of the property and mention your share in the property if applicable.

Now, enter the captcha code shown on the screen to verify you are a human and not a robot.

4. Submit the Application

Double-check all the information to ensure it matches the official documents, such as your CNIC, and then click the submit button to submit your application.

5. Verification Process

After submitting your application, you will receive verification codes sent to both your registered mobile number and email address.

- Enter the verification codes separately in the relevant fields.

- Click the submit button once both sides have been entered correctly.

6. Get FBR Password and Login

After the submission, FBR will take 2 to 3 business days for verification.

Upon successful verification, you will receive your FBR username along with a password. The credentials will be sent to both your email address and mobile number.

7. Log in to the IRIS and Apply for NTN

After the approval, use the FBR username and password to log in to the IRIS 2.0 portal. From here, you will submit the form for the NTN. The portal will provide a token number for tracking your application status. Wait for approval, it typically takes about one working day.

In addition to individual NTN, you can also apply for NTN for your AOP, partnerships, LLPs, private limited companies, and single-member companies through the portal.

8. Collect Your NTN Certificate

You will be notified via email once your NTN is issued. In the old days, you would have to visit the Taxpayer Facilitation Center with your CNIC to collect your registration certificate. But nowadays, you don’t need to visit the office; you can download your NTN certificate from your IRIS portal.

How to Manually Obtain the National Tax Number?

If you prefer to register your National Tax Number manually, then visit the nearest Regional Tax Office (RTO) of the FBR in your region. The FBR representative will review your documents and the information provided. After successful verification, FBR will issue your NTN.

Benefits of Getting an NTN in Pakistan

Here’s why obtaining your National Tax Number is not just important—but beneficial.

- Simplified Tax Filing: NTN streamlines the tax filing process for a simpler and faster experience. Moreover, it also makes it easier to remember your tax obligations.

- Financial Transparency: NTN registration makes it easier for individuals and businesses to correctly record their income, expenses, and tax obligations, which helps ensure transparent financial records.

- Eligibility for Government Contracts & Incentives: Many government tenders and contracts require an NTN. If you are a business or contractor, you should get an NTN. Similarly, they can also benefit from a range of initiatives, subsidies, and incentives.

- NTN Certificate: Some financial dealings require an NTN certificate. It is proof of your tax registration that some companies or contracts may require.

- Tax Benefits: Registered taxpayers have access to several tax benefits, including deductions, rebates, and loss carryovers, which can significantly reduce their tax liability. It also helps minimize excessive withholding taxes.

FAQs

How to verify the NTN number?

To verify the NTN, visit the FBR NTN registration verification.

- On this page, add the parameter type, registration number, and date.

- Lastly, fill out the captcha and click verify

It will provide the essential information and verify your NTN number.

Is there any fee for obtaining NTN number?

No, there is no official fee to get an NTN through FBR. However, you may incur document processing charges like PKR 200 for the Manual challan bank charge (if used).

What should I do if I encounter issues while applying for the NTN number?

If you encounter issues while applying for an NTN:

- Check the FBR’s FAQ section for common problems and solutions.

- Contact the FBR helpline for assistance.

If the problem persists, contact professional tax experts for assistance.

Can Non-residents Apply?

Non-resident Pakistanis and foreign nationals can apply for an NTN, typically through the FBR’s online IRIS portal, provided they earn Pakistan-sourced income or have financial ties within the country. They may need to appoint a local proxy for document verification, but the process follows the same steps as resident taxpayers.

What if I lose my NTN?

If you lose your NTN, you can easily retrieve it online using your CNIC via FBR’s IRIS portal. Otherwise, contact FBR helpline (0800‑99012) or visit your regional tax office to recover or reissue your NTN.

Conclusion

National Tax Number is an indispensable component of Pakistan’s tax framework that serves as a unique identifier issued by the FBR to individuals and businesses engaged in taxable activities. The foundational step ensures financial transparency, regulatory compliance, and long-term success in Pakistan’s economic landscape.

We have walked you through the step-by-step process of acquiring through the user-friendly FBR IRIS portal online and manually from a Regional Tax Office (RTO).